Featured

How Do Calls And Puts Work

Your call will auto-exercise without your say-so if its in the money by just 001 or more if you hold it to expiration and you have the available assets to exercise. Calls are options that give you the right but not the obligation to buy an underlying asset like a stock or index.

Puts and calls are used in trading stocks commodities or foreign exchange.

/call-and-put-options-definitions-and-examples-1031124-v5-8566395195f0403aaf5b4ad9e5cc9364.png)

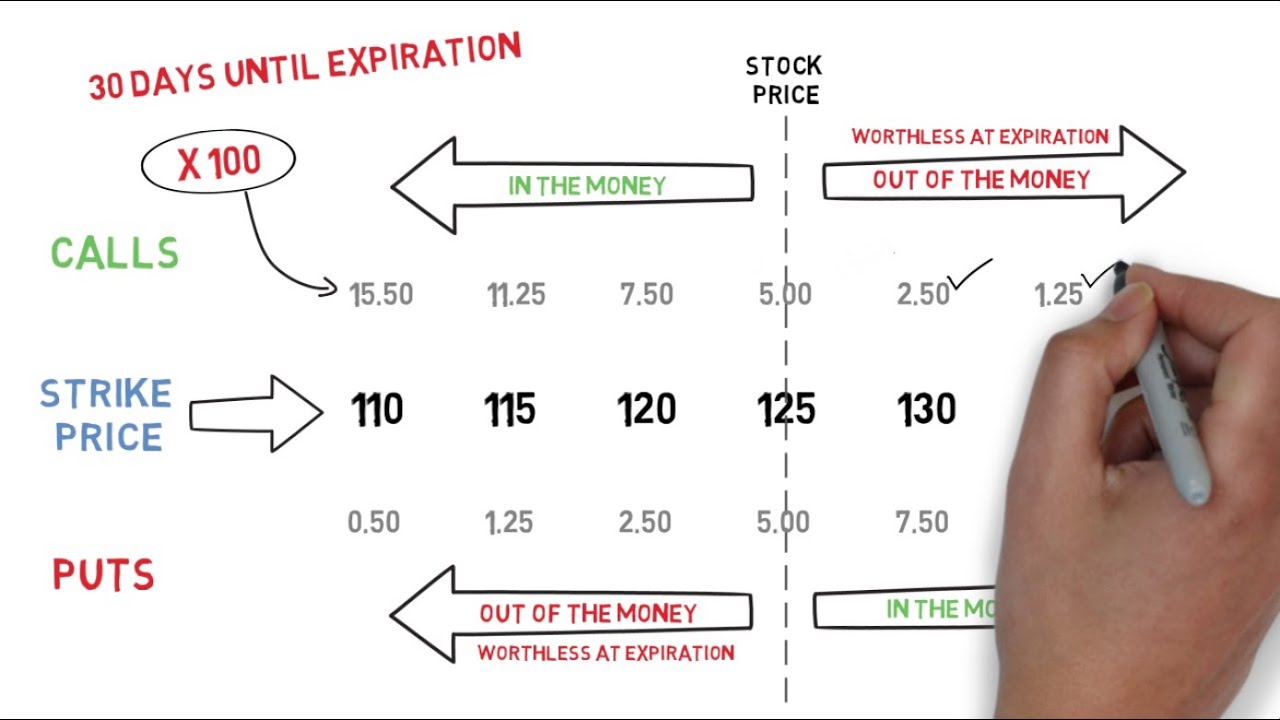

How do calls and puts work. Calls have intrinsic value if the stock is trading above the strike price. A Microsoft 25 call for. Call Options Call options are the right to buy a share at a predetermined price.

Here we go further and explore the two main flavour of options at those traded on the open market. That said most investors stay away from options because they think they are complicated and risky. When you exercise a call youre on the hook to purchase 100 shares of the stock at the strike price.

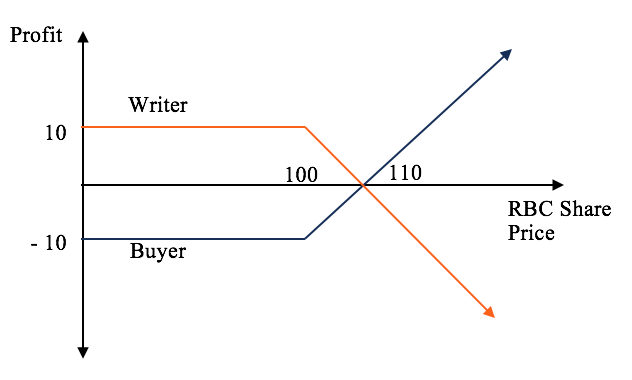

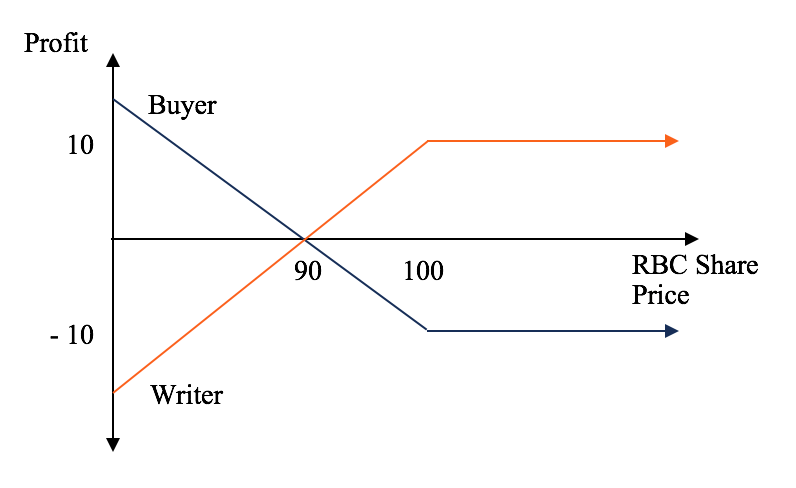

If the price goes down below the locked-in price you buy at the. The opposite of a call option where investors place an order to sell their shares at a certain price within a certain time frame. So a call assignment requires the writer the trader who sold the call option to you to sell his stock to you.

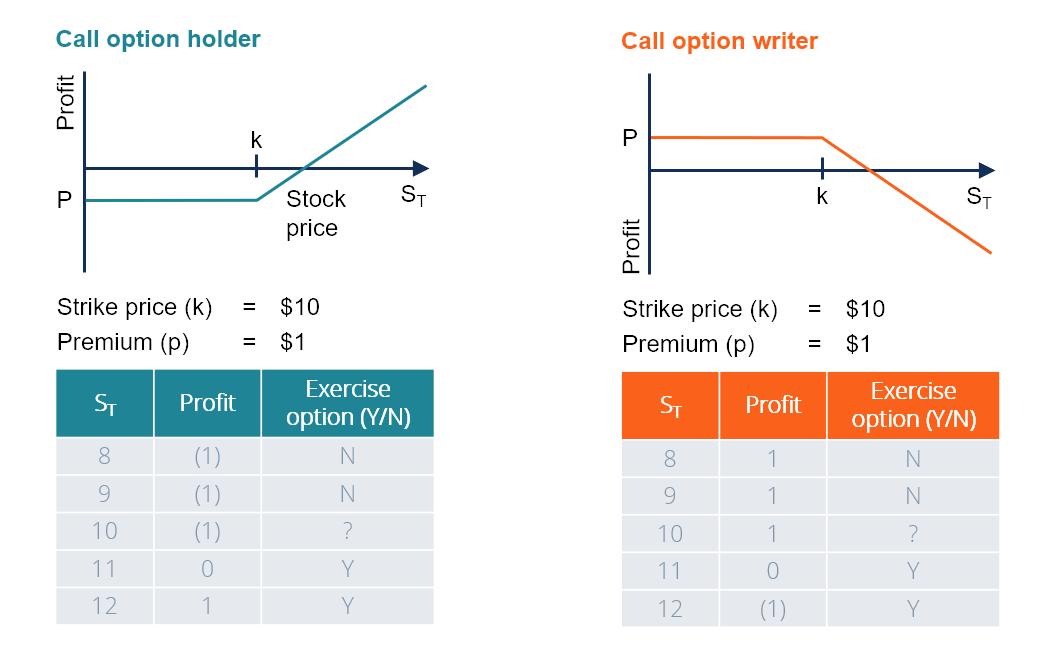

For put sellers if the market price falls below the strike price the buyer could exercise the option forcing them to buy shares for more than they would have to pay on the open market. The seller of a put or call. How Call Options Work.

There are two ways to settle squaring off and physical settlement. At worst they can lose the premium they paid to buy the option. As with calls the person buying the put has limited risk.

A put option is bought if the trader expects the price of the underlying to fall within a certain time frame. Puts and calls can also be written and sold to other traders. To illustrate how a call option works lets use the example above.

You lock in the price you can buy at. The contract sets a. A call option is bought if the trader expects the price of the underlying to rise within a certain time frame.

Can you explain how puts calls work simply. Puts and Calls Explained Heres How They Work If youve ever heard about options trading then youve probably heard about puts and calls. In trading both puts and calls the options trader pays for the right to sell using a put option or right to buy using a call option.

If a stock is trading at 60 per share you may predict that the price will rise in the near future. So if you buy a call option you have the right to buy the underlying stock or index. Weve seen before exactly what options are how they work and their function.

If the price goes up above the locked-in price you buy at the. You lock in the price you can sell at. The buyer of a put or call retains the option to sell or buy the underlying equity at the contract price also known as the strike price.

If you decide to square off your position before the expiry of the contract you will have to sell the same number of call options that you have purchased of the same underlying stock and maturity date and strike price. What Are Puts and Calls. How Do Puts Calls Work in the Stock Market.

A call option is a contract to buy a stock at a set price and within a limited time. For a buyer of a call option. A put assignment on the other hand requires the person who sold you the put on the other side of the trade again the put writer to buy the stock from you the put holder.

What Are Puts and Calls. How do puts and calls work.

Options Trading Understanding Option Prices Youtube

Options Trading Understanding Option Prices Youtube

:max_bytes(150000):strip_icc()/BuyingPuts-d28c8f1326974c16807f23cb32854501.png) Options Trading Strategies A Guide For Beginners

Options Trading Strategies A Guide For Beginners

:max_bytes(150000):strip_icc()/OPTIONSBASICSFINALJPEGII-e1c3eb185fe84e29b9788d916beddb47.jpg) Essential Options Trading Guide

Essential Options Trading Guide

/call-and-put-options-definitions-and-examples-1031124-v5-8566395195f0403aaf5b4ad9e5cc9364.png) Call And Put Options What Are They

Call And Put Options What Are They

Call Option Understand How Buying Selling Call Options Works

Call Option Understand How Buying Selling Call Options Works

What Is A Call Option And A Put Option And How Does It Work Selling A Call

What Is A Call Option And A Put Option And How Does It Work Selling A Call

Options Calls And Puts Overview Examples Trading Long Short

Options Calls And Puts Overview Examples Trading Long Short

Put Options Explained Covered Call Basics

:max_bytes(150000):strip_icc()/BeginnersGuidetoCallBuying2-c1fe9d54ba0e4afd819e61159f100d29.png) Beginner S Guide To Call Buying

Beginner S Guide To Call Buying

/call-and-put-options-definitions-and-examples-1031124-v5-8566395195f0403aaf5b4ad9e5cc9364.png) Call And Put Options What Are They

Call And Put Options What Are They

Options Calls And Puts Overview Examples Trading Long Short

Options Calls And Puts Overview Examples Trading Long Short

/LongPut2-3d94ffb6f6964e578b68c7ec25bd1acd.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Call_Option_Definition_Apr_2020-01-a13f080e7f224c09983babf4f720cd4f.jpg)

Comments

Post a Comment