Featured

Active Vs Passive Management

These two hurdles are the funds cash holding - which means less than 100 of active AUM is competing against 100 of passive AUM - and fees. Active management is overseen by investment professionals striving to outperform specific benchmarks.

Active Vs Passive The Blindfolded Monkey Debate Ftadviser Com

Active Vs Passive The Blindfolded Monkey Debate Ftadviser Com

There are two main camps when it comes to fund management.

Active vs passive management. Active managers could gain an advantage from this if they can time the market but this is very hard to do consistently. Passive investing involves less buying and selling and often results in. That depends who you ask.

Big stocks small stocks value or growth foreign or domestic can all be accessed by passive techniques. Passive Investing There is a fundamentally different focus for active and passive investing. Generally active management has higher fees than passive management.

The Difference Between Active vs. Active management on the other hand has the potential to generate both. After accounting for fees it almost guarantees below-market returns.

The choice between active and passive investing can also hinge on the type of investments one chooses. Non Passive Rental Income Lets say you own several rental properties and spend 50 hours a month managing maintaining and finding tenants for your properties. As previously mentioned by their very nature actively managed funds offer a higher return potential but that.

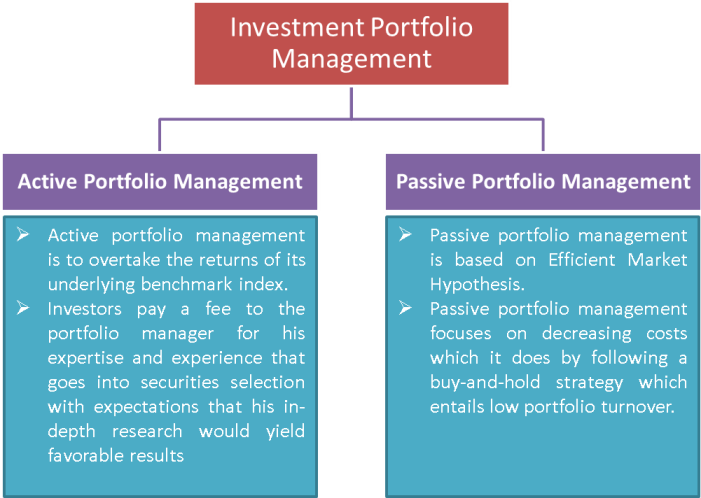

Passive management gives investors cheap exposure to the market without the potential for above-market returns. Comparing Active and Passive Management Returns. Active management is the art of stock picking and market timing.

The Active vs. Although some form of. Active managers make investment decisions in an effort to outperform their benchmark while passive managers simply track an index to gain exposure to a market or segment of a market.

How much do these hurdles affect parity ceteris paribus. But when it comes to active versus passive investing which is the best investing strategy may be less. With active management investment experts are hired based on the perceived value they can add above and beyond the benchmark.

Passive management generally works best for easily traded well-known holdings like stocks in large US. Corporations says Smetters because so much is known about those firms that active managers are unlikely to gain any special insight. Active managers do invest in cash while passive managers dont.

It can be applied to any asset class. Passive management ie index ETFs index funds attempts to replicate the return pattern of a specific benchmark. Active fixed-income managers have almost universally emphasized the importance of security selection in their investment process and as one of the key drivers of why they have typically been able to outperform passive alternatives over time.

While passive investing has grown in popularity over the last few years Morgan Stanley Wealth Management has found that in many cases active management may help investors improve their risk-adjusted returns. The rental income from these properties is still considered passive even though youre spending 500 hours a. Active investing requires a hands-on approach typically by a portfolio manager or other so-called active participant.

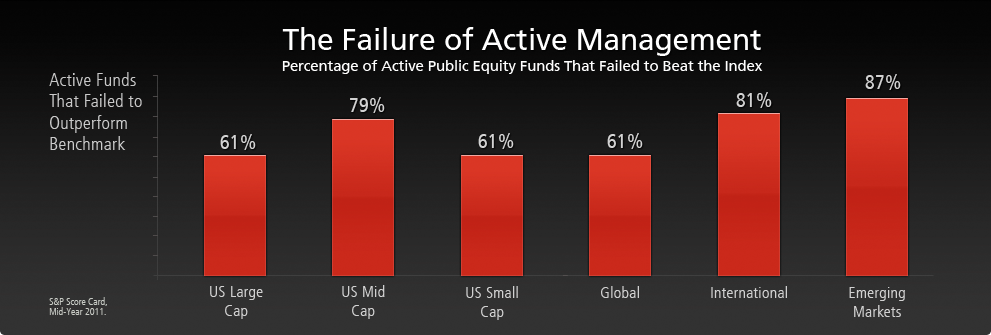

Proponents of passive management insist that active managers cannot consistently outperform a passive benchmark and therefore investors are better off to invest in lower cost index. Passive Debate The debate between active management and passive management has being ongoing for several years. Active managers have two primary disadvantages or hurdles to get over in order to consistently beat passive returns.

Fees have been one of the biggest draws for. In contrast to passive management you may think that active management has been around since the first stock was traded. Passive management refers to a buy-and-hold approach to money management.

Active funds and passive funds.

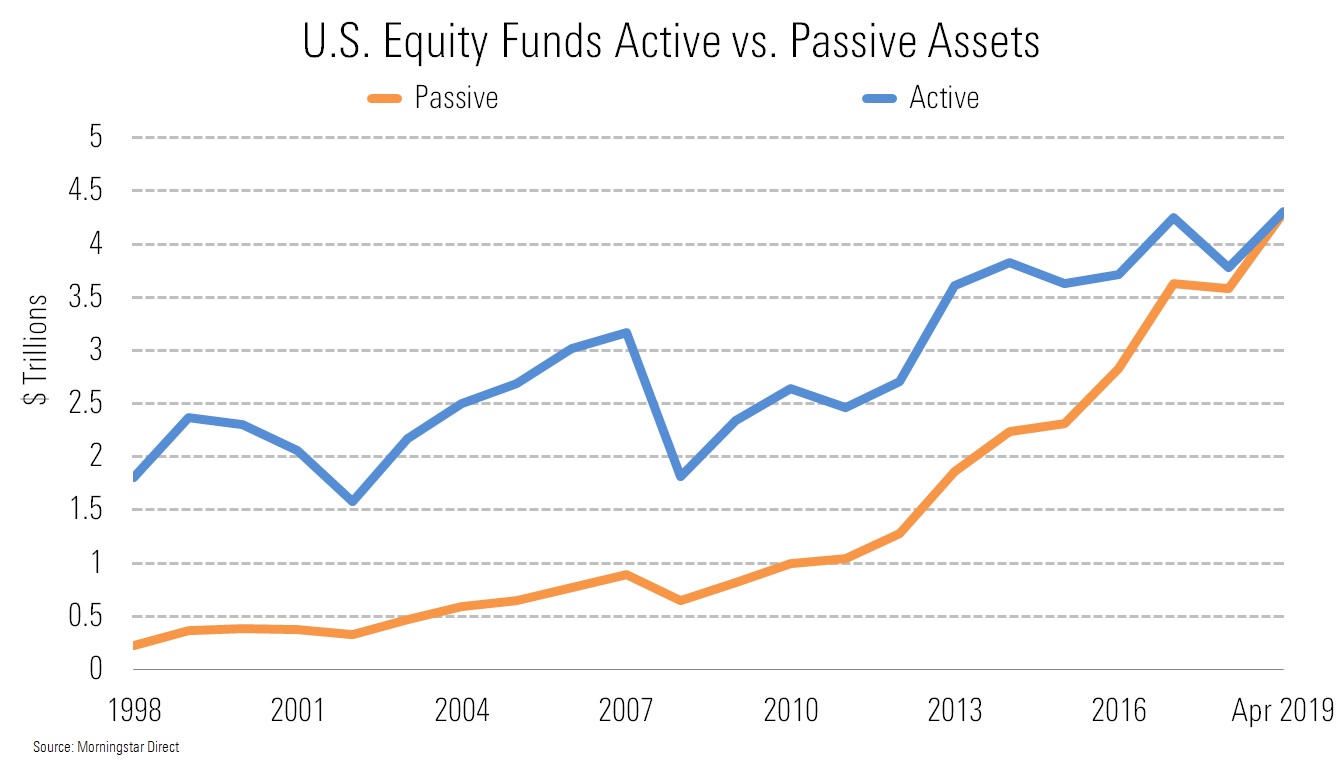

A Look At The Road To Asset Parity Between Passive And Active U S Funds Morningstar

A Look At The Road To Asset Parity Between Passive And Active U S Funds Morningstar

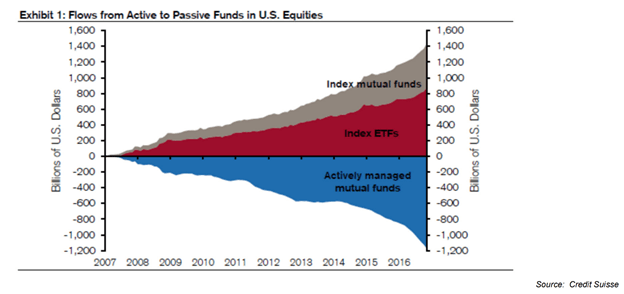

Active Vs Passive Investing Management Styles What It Means

Active Vs Passive Investing Management Styles What It Means

Passive Versus Active Management Optima Group Inc

/34_thinkstockphotos457073653-5bfc4678c9e77c005185e6e3.jpg) The Difference Between Active Vs Passive Investing

The Difference Between Active Vs Passive Investing

The Percentage Split Between Active And Passive Fund Management

The Percentage Split Between Active And Passive Fund Management

Active Vs Passive Funds An Overview And Case Study Don T Quit Your Day Job

Active Vs Passive Funds An Overview And Case Study Don T Quit Your Day Job

Active Vs Passive Investing Why Passive Investing Is Better

Active Vs Passive Investing Why Passive Investing Is Better

The Impact Of Technology On Active Vs Passive Management Tabbforum

The Impact Of Technology On Active Vs Passive Management Tabbforum

Active Vs Passive Investment Management Solari Financial Planning

Active Vs Passive Investment Management Solari Financial Planning

Active Vs Passive Portfolio Management Impact Of Costs On Investments

Active Vs Passive Portfolio Management Impact Of Costs On Investments

Stocks Active Vs Passive Vs Factor Investing Meetinvest

Stocks Active Vs Passive Vs Factor Investing Meetinvest

Active Vs Passive Management Still The Right Question Mitonoptimal Group

Active Vs Passive Management Still The Right Question Mitonoptimal Group

Active Vs Passive Management Income Research Management

Passive Active And The Coming Equilibrium Institutional Investor

Passive Active And The Coming Equilibrium Institutional Investor

Comments

Post a Comment