Featured

How To File Tax Return After Deadline

There is no penalty for filing a late return after the tax deadline if a refund is due. How to file your prior year tax return.

/income-tax-deadlines-2021-75aaceca6a8f47eabc8a17a9185f24ac.png) Federal Income Tax Deadlines In 2021

Federal Income Tax Deadlines In 2021

You can only e-file a current year tax return between mid-January when e-file opens and mid-October when it closes the year after the tax year in question.

How to file tax return after deadline. Originally the last date to file returns for tax year 2020 was September 30 2020 for taxpayers including salaried persons business individuals corporate entities having special year etc. There is no penalty for filing a late return after the tax deadline if the taxpayer receives a refund. Get that tax return filed and make it a priority now.

Get our online tax forms and instructions to file your past due return or order them by calling 1-800-Tax-Form 1-800-829-3676 or 1-800-829-4059 for TTYTDD. Get A 100 Accuracy Guarantee With HR Block for your US. Penalties and interest only accrue on unfiled returns if taxes are not paid by April 18.

That means taxpayers who owe money dont need to file a tax return until this date and if they owe money they dont need to make payments until then. 15 to file your tax return. The Income tax department allows a taxpayer to file the ITR after the deadline in certain cases.

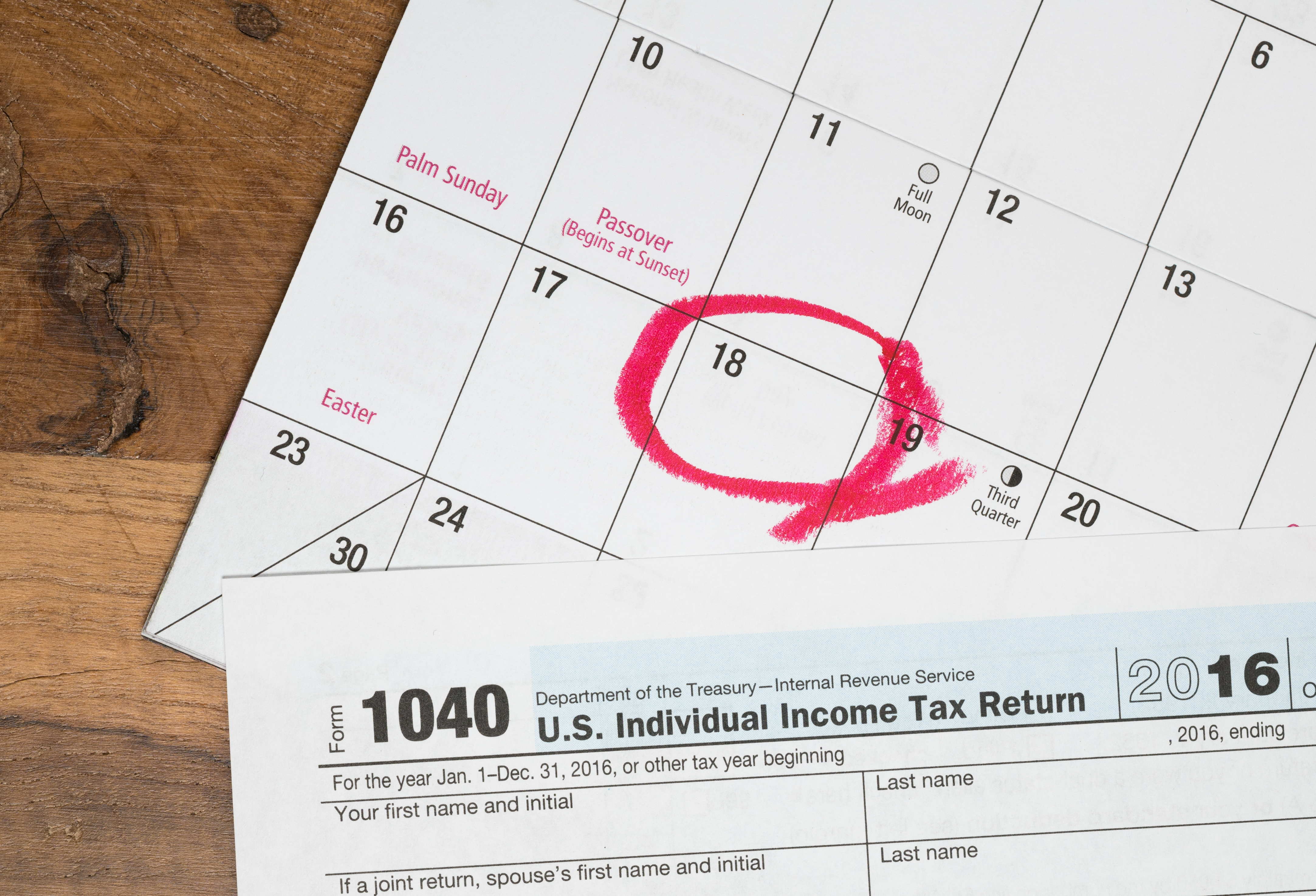

If a belated return is filed after the income tax due date the taxpayer would be liable to pay the tax along with Interest 1 per month simple interest under Section 234A. Learn more about how to file back tax returns and. What Is Extended for 2021 On March 17 2021 the IRS officially extended the federal income tax filing deadline from April 15 to May 17.

For 2020 Tax Returns this is by April 15 2024. If you owe tax submitting your extension to give you more time to file and pay. Anzeige Trust The Experts At HR Block To Guide You Step By Step Through Your Expat Taxes.

If you expect to owe money youre required to estimate the amount due and pay it with your Form 4868. You may file after the tax deadline with TurboTax and the CRAs NETFILE service accepts both current year and some prior year returns long after the annual tax deadline. So there is a simple solution.

Self-employed individuals have until June 15th to file their tax return and get a refund. When the deadline is different Submit your online return by 30 December if you want HMRC to automatically collect tax you owe from your wages and pension. If you are owing taxes to the government after the tax deadline of April 30th late-filing penalties andor interest may apply.

After three years the refund is gone. If you need more time you can request four additional months by filing Form 4868. Anyone who did not file and owes tax should file a return as soon as they can and pay as much as possible to reduce penalties and interest.

Tax Deadline Extension. This is why you will need to send in a physical copy of your return to the IRS. Penalties and interest only accrue on unfiled returns if taxes are not paid by April 18.

Heres a step-by-step guide on how to file belated income tax returns. An extension of time to file your return does not mean an extension of time to pay your taxes. However you must file your return within three years after the original return deadline to claim your refund.

The IRS provided taxpayers an additional day to file and pay their taxes following system issues that surfaced early on the April 17 tax deadline. If you filed an extension by May 17 2021 2020 tax year deadline it extends your filing deadline to October 15 2021. After 60 days pass you will incur an established minimum penalty that is the lesser of 205 or 100 of the unpaid tax you owe.

The process of filing a belated return is the same as filing the return on or before the due date. The 2021 tax filing deadline for Canadians is on April 30 2021. Anzeige Trust The Experts At HR Block To Guide You Step By Step Through Your Expat Taxes.

If NETFILE is not available for the year youre trying to file youll need to print and mail your return. Get A 100 Accuracy Guarantee With HR Block for your US. If you have not registered yourself on the income tax website register using your unique Permanent Account Number or.

Here is how to file an Income Tax Return after the due date. Go to the income tax departments portal - incometaxindiaefilinggovin and click on log in here. The CBDT has issued a circular in regard to a person who has forgotten to file a return or who wants to carry forward his loses or has tax refund pending he can file an application for condonation of delay to the concerned authority or Income Tax Commissioner.

Application for Automatic Extension of Time To File by June 15. But when filing this form you must pay the tax owed. You have until Oct.

Each year the IRS shuts down their e-file system come mid-October. If you are experiencing difficulty preparing your return you may be eligible for assistance through the Volunteer Income Tax Assistance VITA or the Tax Counseling for the Elderly TCE programs.

Tax Day 2021 Deadline The Last Day You Can File And How To Get An Extension Cnet

Tax Day 2021 Deadline The Last Day You Can File And How To Get An Extension Cnet

Missed 2016 Tax Deadline How To File Your 2016 Taxes

Missed 2016 Tax Deadline How To File Your 2016 Taxes

Tax Deadline 2020 Federal And State Tax Return Filing Deadlines Are Wednesday July 15 Masslive Com

Irs Delays Us Tax Deadline To May 17 After Disruptive Year Hindustan Times

Irs Delays Us Tax Deadline To May 17 After Disruptive Year Hindustan Times

Deadline To File State Taxes H R Block

Deadline To File State Taxes H R Block

China Clarifies Deadlines For Filing Tax Returns In 2021 China Briefing News

China Clarifies Deadlines For Filing Tax Returns In 2021 China Briefing News

New Deadlines For Filing Tax Returns As Required By Section 1308 Chapter 13 Trustee Edky Trustee S Blog

New Deadlines For Filing Tax Returns As Required By Section 1308 Chapter 13 Trustee Edky Trustee S Blog

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

Late Filing Or Late Payment Penalties Missed Deadline 2021

Late Filing Or Late Payment Penalties Missed Deadline 2021

What Happens If You Miss The Tax Return Deadline Freeagent

What Happens If You Miss The Tax Return Deadline Freeagent

I Missed The Deadline To File My Tax Return Now What Wagner Tax Law

I Missed The Deadline To File My Tax Return Now What Wagner Tax Law

Everything You Need To Know About The 2021 Tax Deadlines Forbes Advisor

Everything You Need To Know About The 2021 Tax Deadlines Forbes Advisor

Filing Tax Return Internal Revenue Code Simplified

Filing Tax Return Internal Revenue Code Simplified

:strip_icc()/how-soon-can-we-begin-filing-tax-returns-3192837_final-eab4eb98b0394fb1b93c6dc6876b4062.gif) When Is The Earliest You Can File Your Tax Return

When Is The Earliest You Can File Your Tax Return

Comments

Post a Comment