Featured

How Much Will My Credit Score Increase

Not making any credit applications for 6 months adds 50 points to your score. If you already have a credit score in the 800s and you make payments on a car loan it wont go much higher because the highest you can go is 850.

5 Sneaky Ways To Improve Your Credit Score Clark Howard

5 Sneaky Ways To Improve Your Credit Score Clark Howard

We suggest using a reputable.

How much will my credit score increase. If youre able to get that limit bumped up to 20000 you are now only using 5 of your available credit without making a single new payment. Open a secured credit card Make all of your payments on time Dont keep a credit card balance of more than 30 of your credit limit Keep accounts with good credit history open Only spend as much as you can afford to pay off completely at the. Pay every bill on time.

This will help to increase your score. Here are some of the best ways to gain points and and maintain a strong credit file. Keep a credit card for more than five years.

For example if you have other severe negative items in your credit history you may not see an increase even after the bankruptcy is removed. Here are some quick tips on improving your credit score. Unless your credit was pulled without your permission the only to remove an inquiry is to.

My wife and I plan to get our first house in the next 90 days. If you make payments on time your credit score will grow. How many points and how fast you can increase your credit score depends on the factors discussed above.

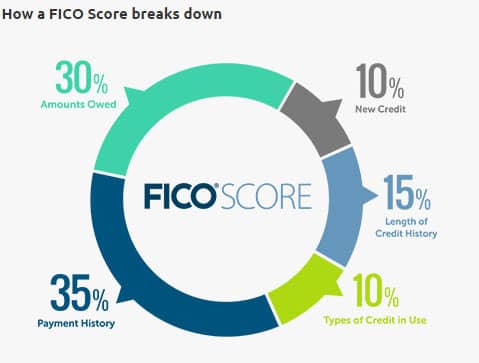

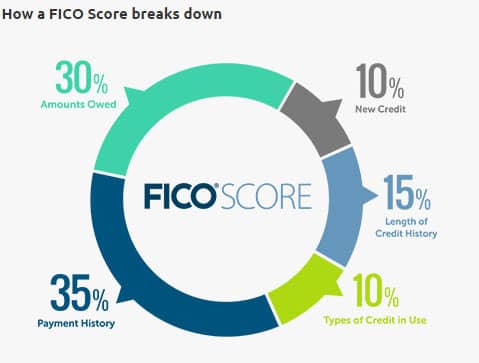

Due to this its likely my credit scores are going to go down. Payment history is the other major factor in scores along with utilization. If I have a 20000 limit and Im using 15000 of it my credit utilization is at a high 75 percent.

Rebuilding a credit score requires patience and. How Much Will Your Credit Score Rise When Negative Items Come Off. I have a chapter 7.

One of the best ways to improve your credit score is to make sure that you pay your current bills on time. If I can make a payment on this credit card and get my balance down to 5000 which would be a 25 percent utilization ratio my credit scores are likely to take a good jump higher. If you remove one collection and you have five total you may not see any increase at all--youre just as much of a risk with 4 collections as 5.

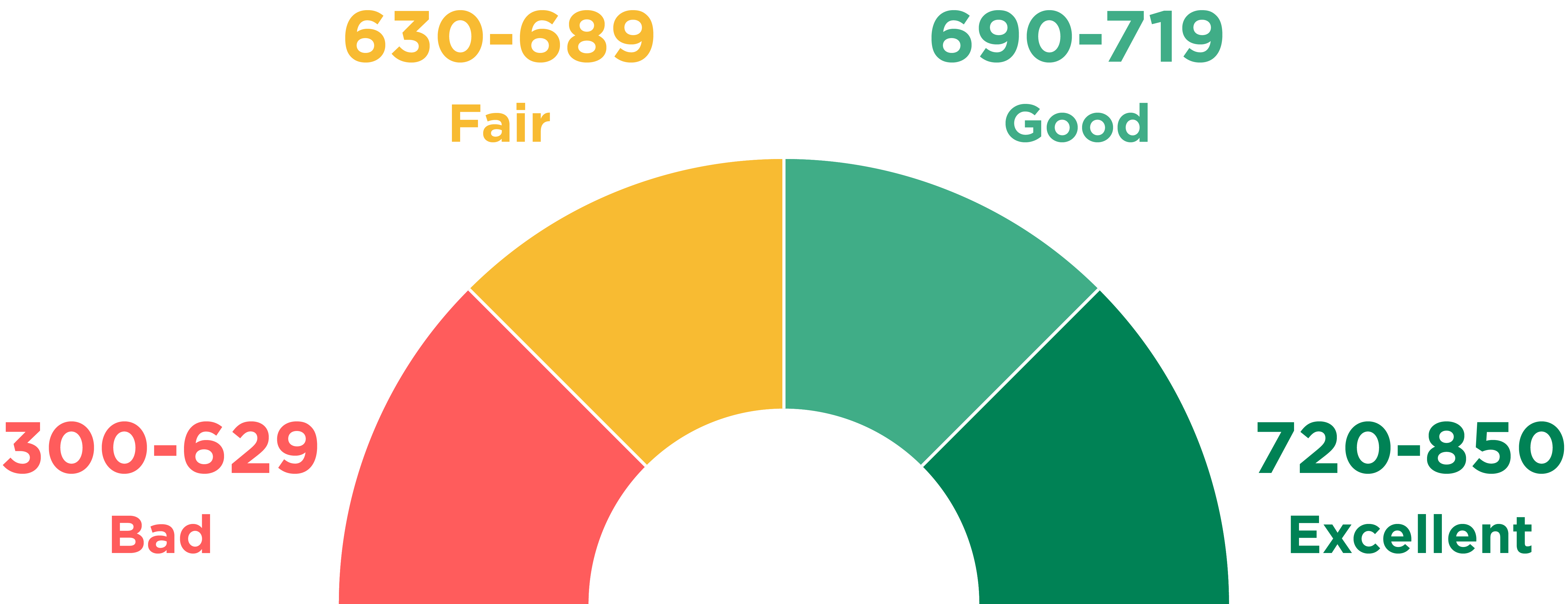

A financial advisor can advise you on the benefits you will see. Todays Equifax score is 659. If the collection has lowered your score by 100 points getting it deleted should increase your score by 100 points.

If its the only collection account you have you can expect to see a credit score increase up to 150 points. Paying credit cards and loans on time is the biggest factor in improving your scores and it shows creditors that you. Once your balance starts to exceed the 30 threshold youll notice your.

By actively working to improve your credit score its possible to raise it out of the high-risk category and eventually into the 700s or higher to a maximum score of 850. Whether your credit scores increase and by how much depends on the other information in your credit report as well as the credit scoring model being used to calculate your score. But if you have a low credit score like in the 400s making regular.

Credit Score Increase of 42 Points. Without a better credit score. We dont have any shared credit.

Its important to understand what your credit utilization ratio is. Your credit utilization ratio is calculated by dividing the credit. There are a handful of ways to gain points but the best way to improve your credit scores is to practice good credit habits over time.

For example that means your credit card balance should always be below 300 on a credit card with a 1000 limit. Our credit score situations are as follows. If you want to improve and maintain a good credit score its more reasonable to keep your balance at or below 30 of your credit limit.

Here are some tips on how you can boost your credit score. Doe were in the market for a new home and needed a mortgage lender in the month of October. But if you are trying to decide which card to close always keep a card with a lower interest rate thats more important than 20 points on your credit score.

Your credit utilization ratio is an influential metric because it is part of a factor that makes up 30 of your score. Paying off any outstanding late payments or collections paying off all of your credit card balances. For mortgage purposes wed both like to bump our Equifax credit scores 10-25 points to 680 minimum.

The impact of high credit utilization First things first. Be Current with Your Current Accounts. The truth is theres no concrete answer as it will depend on how much the collection is currently impacting your account.

And the higher your score the more a late payment can damage it. Credit utilization is simply how much credit you are using divided by the. Its not impossible but its unlikely your credit score will go up 100 points in one month.

Its hard to say though by how many points your credit will raise. We looked at two case studies provided by Mid Oregon Lending to see just how much a credit score could improve by paying off credit card debt. Getting all of your collections removed from your credit report isnt as difficult as you might think.

How to Improve Your Credit Score. However if you do the following things you can increase it even up 50 or 100 points over a few months. This adds 20 points to your score.

Their credit score was 678 but to receive the best rates a 740 and above is needed. Additionally youll want to ensure youve got enough open credit accounts to build a credit history. Theres no way to determine exactly how much your credit score will improve after bankruptcy because it depends entirely on the decisions you make after the 10-year period.

How To Increase Your Credit Score To 800 And Above

How To Increase Your Credit Score To 800 And Above

How To Improve Your Credit Score By 100 Points In 30 Days

How To Improve Your Credit Score By 100 Points In 30 Days

Improve Your Credit Score In 6 Months Blog Details Essex Bank

Improve Your Credit Score In 6 Months Blog Details Essex Bank

![]() How To Raise Your Bad Credit Score Above 700 Mybanktracker

How To Raise Your Bad Credit Score Above 700 Mybanktracker

How To Improve Your Credit Score Moneysavingexpert

How To Improve Your Credit Score Moneysavingexpert

How To Improve Your Credit Score Fast Experian

How To Improve Your Credit Score Fast Experian

/things-that-boost-credit-score-8ee7c4392e764cceb0deae74b741e000.gif) How To Boost Your Credit Score

How To Boost Your Credit Score

How To Improve Your Credit Score By 100 Points In 30 Days

How To Improve Your Credit Score By 100 Points In 30 Days

Why Won T My Credit Score Go Up Refresh Financial

Why Won T My Credit Score Go Up Refresh Financial

8 Ways To Build Credit Fast Nerdwallet

8 Ways To Build Credit Fast Nerdwallet

How To Improve Your Credit Score Tips For Fico Repair

How To Improve Your Credit Score Tips For Fico Repair

How To Raise Your Credit Score By 100 Points In 45 Days

How To Raise Your Credit Score By 100 Points In 45 Days

8 Ways To Build Credit Fast Nerdwallet

8 Ways To Build Credit Fast Nerdwallet

Study How Much Will Paying Off Credit Cards Improve Score Badcredit Org

Study How Much Will Paying Off Credit Cards Improve Score Badcredit Org

Comments

Post a Comment