Featured

- Get link

- X

- Other Apps

How To Fix Defaulted Private Student Loans

Loan rehabilitation is the most effective way to recover from a federal student loan default because if you complete it then the default gets taken off your credit history. Find the student loan servicer that manages your defaulted federal loan by logging in to My Federal Student Aid online.

6 Ways To Stop Student Loan Wage Garnishment Student Loan Hero

6 Ways To Stop Student Loan Wage Garnishment Student Loan Hero

Keep in mind that every lender has its own definition of default.

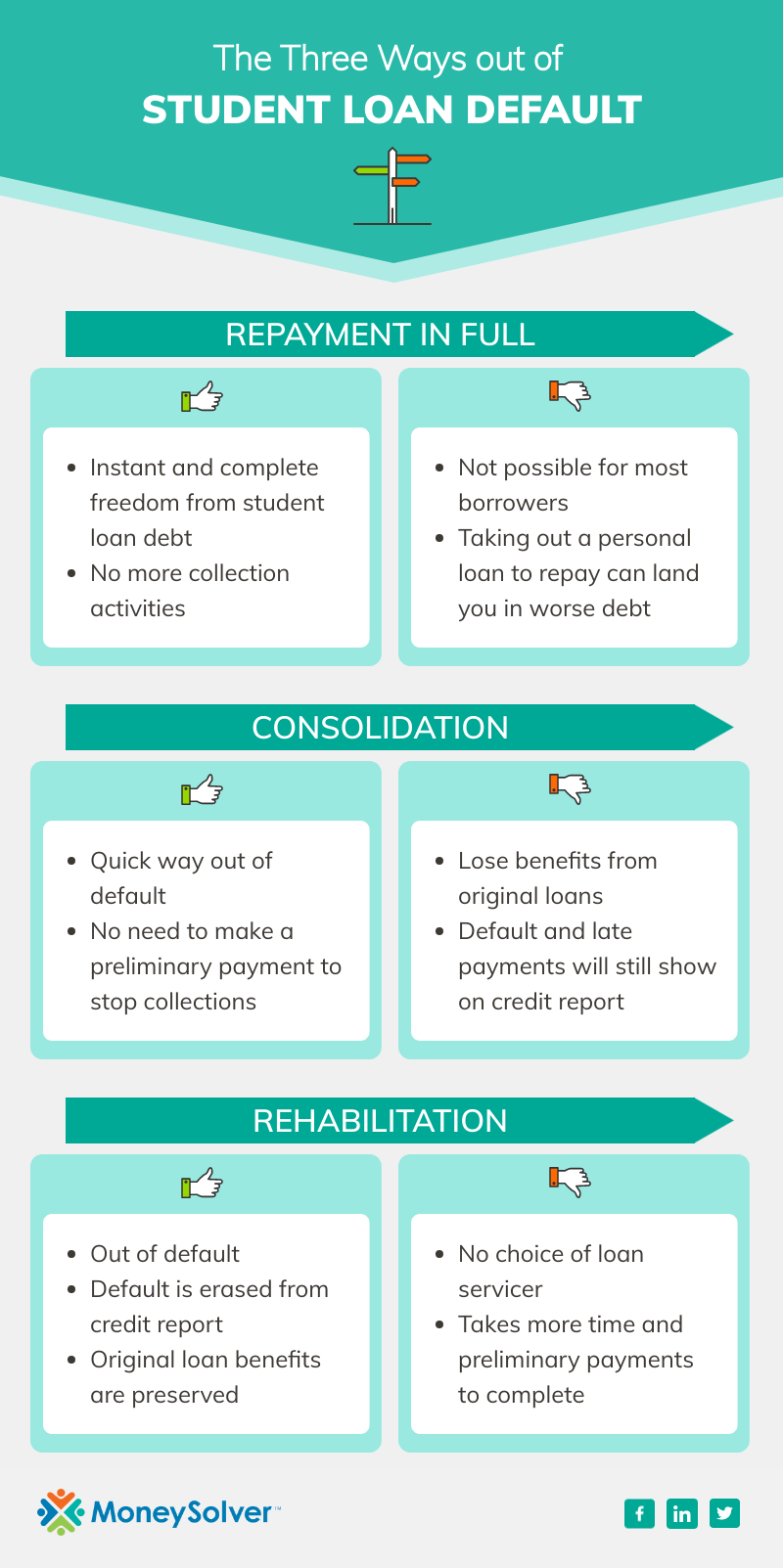

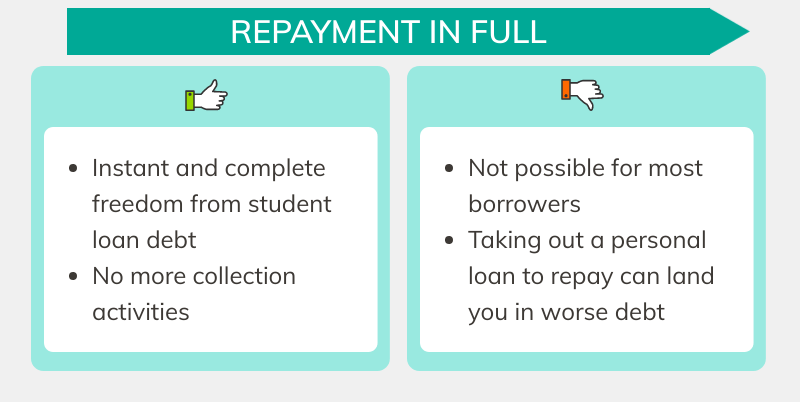

How to fix defaulted private student loans. You could save yourself tens of thousands of dollars just by picking up that phone. Your account also includes information about your servicer if you need it. 1 pay the debt off in full 2 consolidate your student loans and begin making payments or 3 rehabilitate your loans.

You can contact a settlement agency to assist you in the process. Before things get worse get on the horn and start making some moves. The guidelines for obtaining this kind of court order vary depending on the state and there are some states where wage garnishment isnt allowed.

There are typically three options for getting out of default. The key to settling private student loan debt is to know three things. Consolidate the loans Enter a.

Using the contact information listed explain to your servicer that youd like to opt for loan rehabilitation for your defaulted loan. Get the right loan in just a few steps. Federal student loan settlement saved 100 thousand.

Altering the terms of a private loan is much different from doing the same with a federal loan. Get the right loan in just a few steps. If you have private student loans that are in default contact your lender right away.

If you have other sources of debt you may settle all your debt at once. The monthly payment amount youll be offered will be based on your income so it should be affordable. Submit proof of income to your servicer.

When you default on your loan it can be sent to collections at which point you will be notified usually by mail. I chose to rehabilitate my loan. While borrowers with federal student loans get the opportunity to rehabilitate a defaulted loan under federal law private student loan lenders arent required to offer loan rehabilitation programs.

To rehabilitate most defaulted federal student loans you must sign an agreement to make a series of nine monthly payments over a period of 10 consecutive months. Anzeige Find the loan thats right for you. You can rehabilitate federal student loans to get out of default and sometimes private student loans.

How to Recover From Defaulted Student Loans Step 1. In order to repair your credit you need to get out of student loan default first. Submit an enquiry at comparisch.

Some lenders may have rehabilitation programs in place to help overcome student loan. How much you can afford in a lump sum payment. Sign in to your account select a loan and look at its repayment status to see if its listed as in default.

Anzeige Find the loan thats right for you. The Lender Could Garnish Your Wages. If youve got a defaulted private student loan the worst thing you could possibly do is ignore the problem hoping that it will either go away or get better in time.

In order for a lender to garnish your wages because of defaulting on a private student loan they have to get a court order. Generally private student loan default occurs when your payment is overdue for 120 days or four months. Most cases of default occur when a borrower fails to make payments.

Who the loan holder is. Getting Out of Default. Four Options to Cure a Defaulted Student Loan.

With most loans the first step will be agreeing on a lump sum settlement for your current student loans. Federal student loan settlement letter with Professional Bureau of Collections of Maryland PBCM How to negotiate a private student loan settlement. Submit an enquiry at comparisch.

Read through your promissory note or speak directly with your lender to find out their terms. Now in order to get your student loans out of default you have four options.

What S The Difference Between Delinquency And Default Student Loan Hero

What S The Difference Between Delinquency And Default Student Loan Hero

Facing Private Student Loan Default Here Are Your Options Student Loan Hero

Facing Private Student Loan Default Here Are Your Options Student Loan Hero

The Definitive Guide To Get Student Loans Out Of Default

The Definitive Guide To Get Student Loans Out Of Default

How You Can Get Out Of Student Loan Default In 5 Easy Steps

How You Can Get Out Of Student Loan Default In 5 Easy Steps

The Definitive Guide To Get Student Loans Out Of Default

The Definitive Guide To Get Student Loans Out Of Default

How Defaulting On Student Loans Can Impact Your First Job Student Loan Hero

How Defaulting On Student Loans Can Impact Your First Job Student Loan Hero

Student Loan Rehabilitation Program How To Get Out Of Default

Student Loan Rehabilitation Program How To Get Out Of Default

3 Ways To Get Out Of Student Loan Default Ed Gov Blog

3 Ways To Get Out Of Student Loan Default Ed Gov Blog

2020 Guide To Getting Help With Private Student Loan Default Fsld

2020 Guide To Getting Help With Private Student Loan Default Fsld

Can The Student Loan Statute Of Limitations Get Rid Of My Private Loans Student Loan Hero

Can The Student Loan Statute Of Limitations Get Rid Of My Private Loans Student Loan Hero

Student Loan Default What It Is And How To Recover Nerdwallet

Student Loan Default What It Is And How To Recover Nerdwallet

How To Recover From Student Loan Default Forbes Advisor

How To Recover From Student Loan Default Forbes Advisor

Ask The Experts How To Fix The Private Student Loan Market

Ask The Experts How To Fix The Private Student Loan Market

In Student Loan Default How To Fix Credit Student Loan Hero

In Student Loan Default How To Fix Credit Student Loan Hero

Comments

Post a Comment