Featured

How Quickly Can I Refinance My Mortgage

While you can legally refinance at any time there may be some costly consequences to this decision. If you want to refinance an FHA loan with an FHA Streamline Refinance the waiting period is 210 days.

Should I Refinance My Mortgage When To Refinance Mint

Should I Refinance My Mortgage When To Refinance Mint

Only a few lenders are likely to approve refinancing if you have been in your current mortgage for less than a year.

How quickly can i refinance my mortgage. In some circumstances however you may need to wait. Your break-even point is 35 months or about three years. Depending on the situation its possible to refinance a mortgage loan immediately.

Once again this generally means a 12-month waiting period. It depends on the type of refinance And the type of loan you have and desire Rate and term refis may not require a waiting period Cash out refis generally require a wait of six months or longer. The easiest way to figure out if you have any equity is to take the value of your home and multiply it by 80.

If your original loan was modified to make payments more affordable you might need to wait up to 24 months before you can refinance it. Many lenders will require at least a year of payments before refinancing your home. You might have to wait six months before you can refinance with the.

The method can assist you benefit from decrease rates of interest decrease your month-to-month funds with a long run let you take a number of the fairness. When Can I Refinance My Home. Some refuse to refinance in any situation within 120 to 180 days of issuing the loan.

If you want to refinance an FHA loan with an FHA Streamline Refinance a program in which your original FHA loan paperwork is used to process your refinance thereby expediting the. If you want to do a cash-out refinance and gain access to some of the equity you have in the home the waiting period can be at least six months after your current mortgage loan closed. How soon you can refinance depends on the type of mortgage you have.

While some homeowners can refinance shortly. Lenders spend a lot of resources underwriting loans and might not meet their break even point of profitability if you refinance quickly. Theres no legal limit on the number of times you can refinance your home loan.

You cant refinance if there isnt any equity to take out. Equity And Your Refinance. It also depends on the type of refinance youre interested in.

Your refinance timeline depends on the type of mortgage you have. When you can refinance a mortgage by loan type. The more money you put into your home the easier it will be to refinance regardless of when you do.

You have to wait 6 months since your most recent closing usually 180 days to refinance if youre taking cash-out or using a streamline refinance program. A key part of refinancing your mortgage is the amount of equity available. Why Would You Want to Refinance a Mortgage Right After Purchase.

However mortgage lenders do set a few rules that dictate the frequency of refinancing by loan type and there are some special considerations to note if you want a cash-out refinance. If you have a conventional loan backed by Fannie Mae or Freddie Mac you must make three consecutive payments after youve exited. And whereas it is doable to refinance a mortgage quickly after taking out the primary one there are different components to think about earlier than you apply.

Otherwise theres no waiting period to. Refinancing a mortgage includes changing your present mortgage with a brand new loan. How Quickly Can You Refinance Mortgage - If you are looking for lower monthly payments then we can provide you with a plan that works for you.

Can I Refinance My Mortgage - If you are looking for a way to lower your expenses then use our options to help reduce payments. In most cases you may refinance a conventional loan as soon as you want. How Quickly Can I Refinance My Mortgage.

Explore restrictions with your current lender to understand your. How soon can I refinance my FHA mortgage. If you recently purchased your home take a look at how much you put down for your down payment if you only put 5 down there will not be any equity.

How quickly youll be able to refinance your home loa n depends on the type of mortgage you have. When considering refinancing the more relevant question is how long should you wait before refinancing again. It also depends on the type of refinanc.

How quickly can I refinance. Depending on the type of mortgage you. When someone asks us Can I refinance right after buying a home the answer is yes but with reservations.

If you dont plan to stay in your home longer than that a mortgage refi may not be a financially sound move.

How Soon Can I Refinance My Mortgage The Truth About Mortgage

How Soon Can I Refinance My Mortgage The Truth About Mortgage

How Soon Can I Refinance My Mortgage Experian

How Soon Can I Refinance My Mortgage Experian

How Soon Can You Refinance No Waiting Period For Some Mortgage Rates Mortgage News And Strategy The Mortgage Reports

How Soon Can You Refinance No Waiting Period For Some Mortgage Rates Mortgage News And Strategy The Mortgage Reports

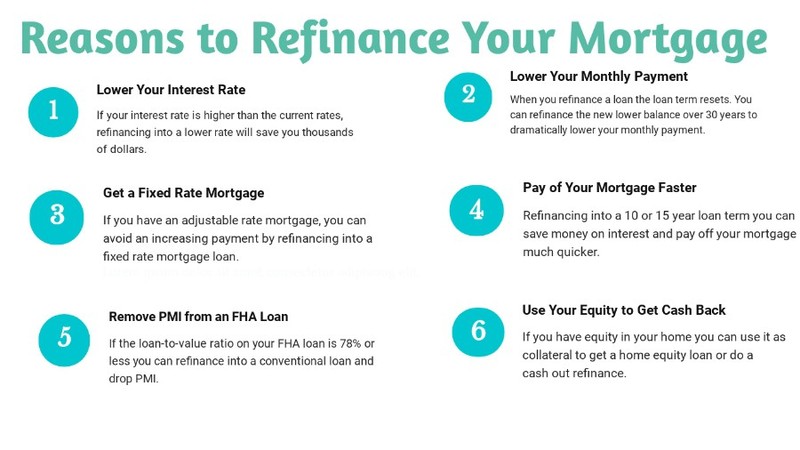

Should I Refinance My Mortgage Beginner S Guide To Refinancing Your Home Loan

Should I Refinance My Mortgage Beginner S Guide To Refinancing Your Home Loan

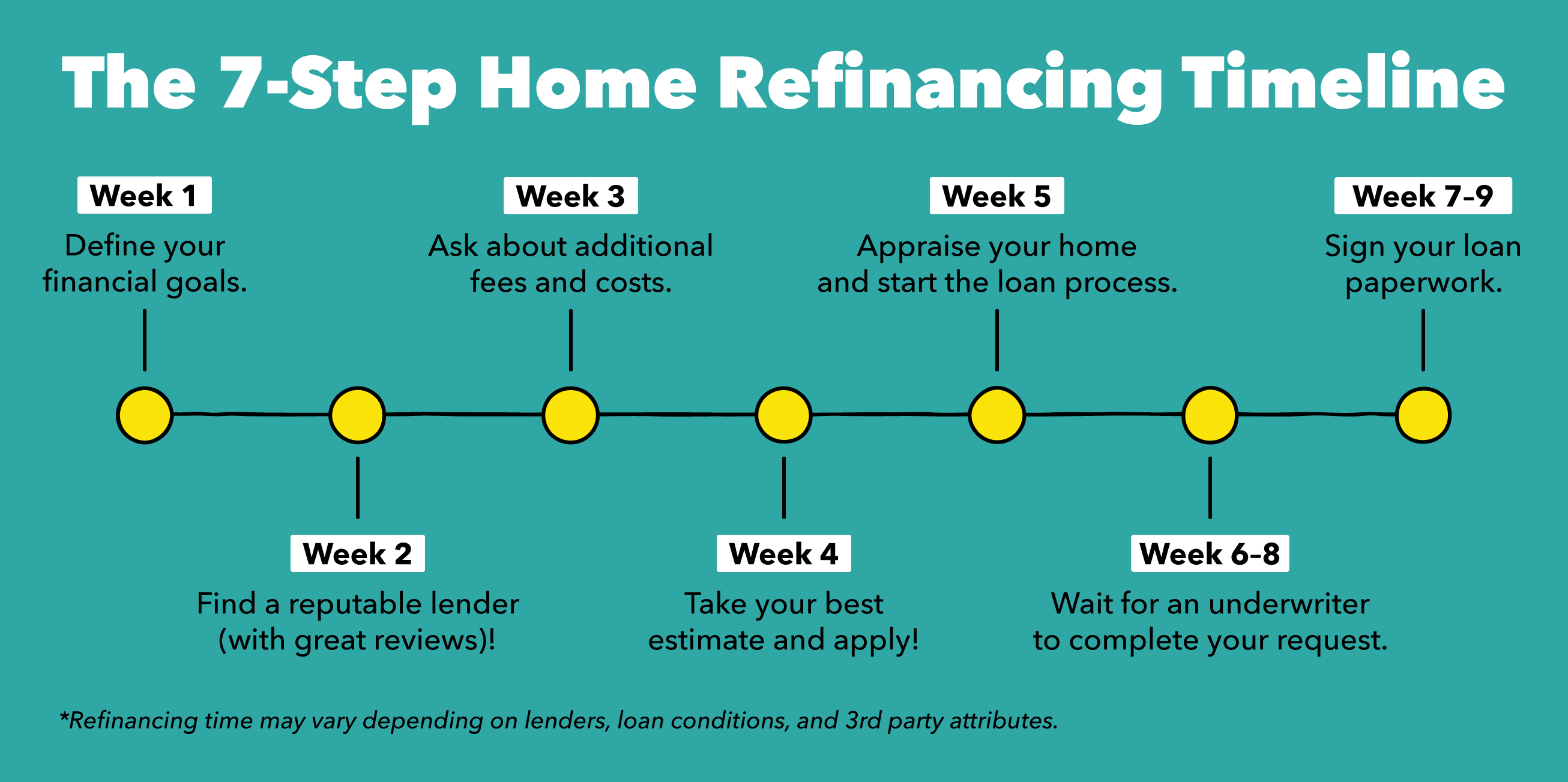

How Long Does It Take To Refinance A House 5 Ways To Speed Up The Process

How Long Does It Take To Refinance A House 5 Ways To Speed Up The Process

Meridian Home Mortgage Review 2020 Smartasset Com

Meridian Home Mortgage Review 2020 Smartasset Com

How To Remove A Name From A Mortgage When Allowed

How To Remove A Name From A Mortgage When Allowed

Should I Refinance My Mortgage Ramseysolutions Com

Should I Refinance My Mortgage Ramseysolutions Com

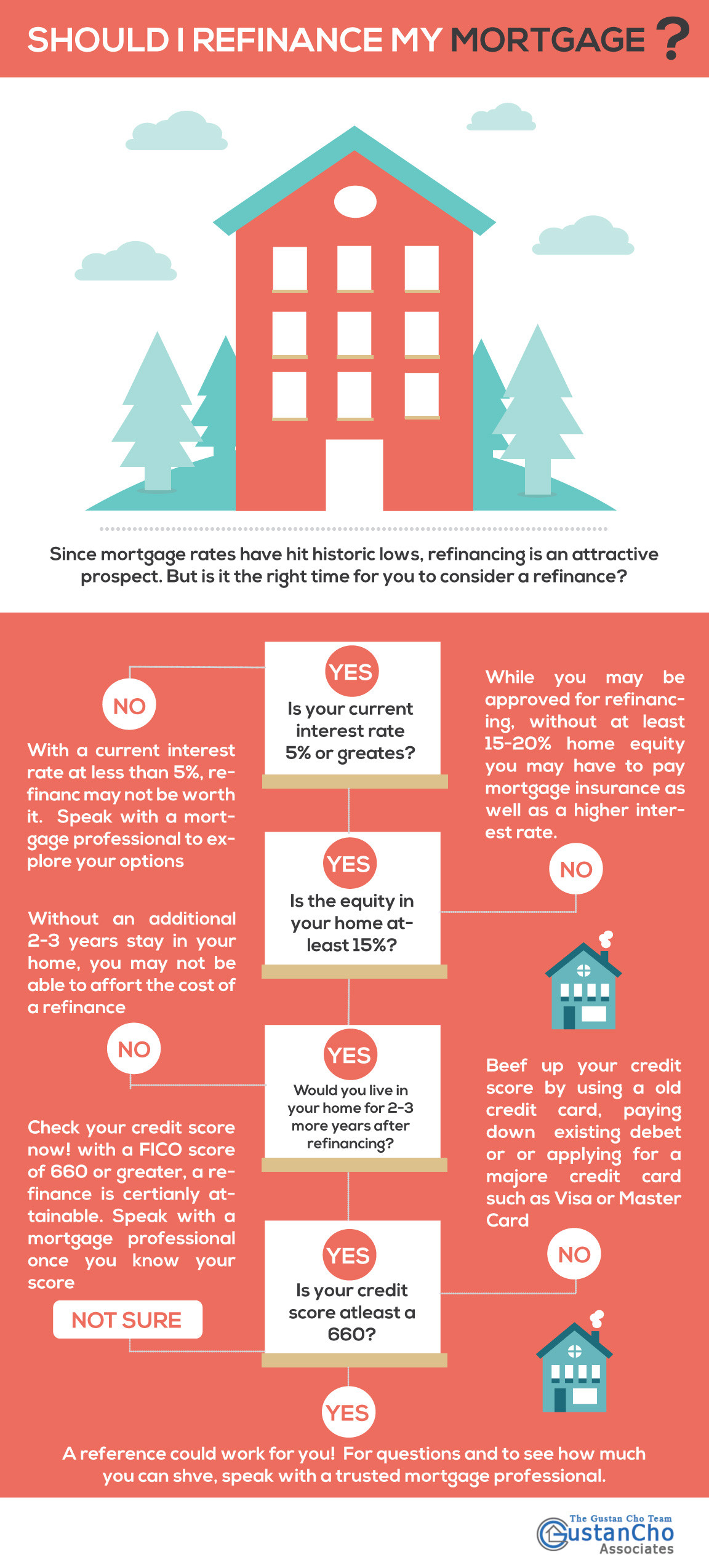

Should I Refinance My Mortgage Infographic Rates At 3 Year Low

Should I Refinance My Mortgage Infographic Rates At 3 Year Low

How Does Mortgage Refinancing Work The Truth About Mortgage

How Does Mortgage Refinancing Work The Truth About Mortgage

Infographic Should I Refinance My Mortgage Mortgage Home Base

Infographic Should I Refinance My Mortgage Mortgage Home Base

Should I Refinance My Home Peglar Real Estate Group Mountain Home Ar

Should I Refinance My Home Peglar Real Estate Group Mountain Home Ar

Should I Refinance My Mortgage Beginner S Guide To Refinancing Your Home Loan

Should I Refinance My Mortgage Beginner S Guide To Refinancing Your Home Loan

Comments

Post a Comment