Featured

How Is My Credit Score Calculated

FICO and VantageScore the two main consumer credit scoring models look for information that indicates if someone is more likely or less likely to miss a payment. Payment history appears on your credit reports from the three major US.

How Your Credit Score Is Calculated The Lenders Network

How Your Credit Score Is Calculated The Lenders Network

As your balances grow this puts downward pressure on your credit score.

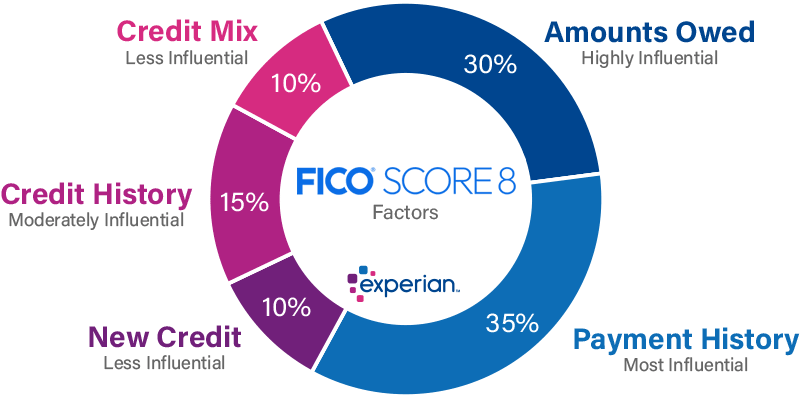

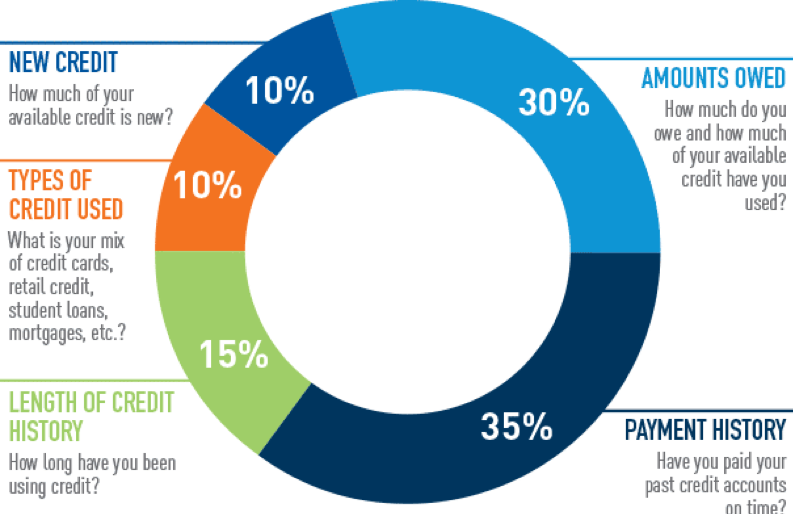

How is my credit score calculated. FICO does not reveal its proprietary credit score calculator formula but it is known that the calculation incorporates five major components with varying levels of importance. How much you owe on your credit accounts. If youre working to improve your credit score you may wonder how frequently your score is calculated and.

Your score is based on five basic things. A key part of your credit score analyzes how much of the total available credit is being used on your credit cards as well as any other revolving lines of credit. How long your accounts have been open.

How frequently credit scores get calculated. Also known as your FICO score your credit score is the result of a specific formula that will ultimately dictate your likelihood of getting approved for a loan or line of credit and at the most. That period of time may vary depending on the credit scoring model but its typically from 14 to 45 days.

However if you are shopping for a new auto or mortgage loan or a new utility provider the multiple inquiries are generally counted as one inquiry for a given period of time. While the exact formula is unknown we do know that FICO scores are calculated by considering five different categories. Heres the approximate breakdown that most major credit score formulas use.

Your payment history for your loans and credit cards. Credit cards overdrafts lines of credit the balances we have on our loans. So naturally if you are in the market for a new home you may be interested in knowing not just what your credit score is but how your credit score is calculated.

Although credit scores are calculated differently by the various credit bureaus you can get an estimate of what your score may be by using this calculator. About one-third or 30 of the calculation relies on how much you owe. Your credit score is calculated using a formula based on your credit report.

Its worth about 35 on your credit score. The largest share or 35 of your credit score is payment history. The three main things that help you have a good credit score are first having a long history of making all debt payments on time second using the proper mix of credit and third not maxing out on available credit.

Your payment history is the biggest factor for your credit scoresit drives 35 of your score. Based on this credit bureaus use algorithms to determine a three-digit score for you. Payment history considers whether youve paid your bills on time frequency of late.

Lets take a look at how your credit score is calculated. A credit score is tabulated by credit bureaus who get information from the banks and companies you do business with about your financial payments. Your credit score informs lenders of your credit worthiness.

Your Credit Utilisation Ratio CUR. The score is calculated using information contained in your credit reports with each of the three main reporting agencies. TransUnion calculates your credit score based on a variety of factors in your credit history such as.

The credit score is a tool to determine a pattern of behaviour for any given borrower. In fact payment history accounts for 30 to 35 per cent of your total credit score. A large number of hard inquiries can impact your credit score.

It shows how well you manage credit and how risky it would be for a lender to lend you money. Your credit scores are determined by credit scoring models that analyze one of your consumer credit reports and then assign a score often ranging from 300 to 850 using complex calculations. Your credit mix eg credit cards mortgages lines of credit How much credit you use and have available.

The importance of each varies as well as the factors within every category. Payment history is the record on your credit report of whether you pay your bills on time. Normally by collating previous years payment history data the credit bureau calculates your credit score.

At 70 of utilization you are in the red zone. Payment History Your payment history is one of the major factors that affect your credit score and is actually the most influential factor in determining your score. Length of credit history accounts for 15.

Your credit score Your credit score is a three-digit number that comes from the information in your credit report. A revolving line of credit is a type of loan that allows you to borrow repay and then reuse the credit line up to its available limit. Lenders look at how much you owe.

Otherwise known as the likelihood of you paying back your debts.

How Is My Credit Score Calculated Money Evolution

How Is My Credit Score Calculated Money Evolution

How Is Your Credit Score Determined Experian

How Is Your Credit Score Determined Experian

How Is My Credit Score Calculated Credit Score Chart Credit Score What Is Credit Score

How Is My Credit Score Calculated Credit Score Chart Credit Score What Is Credit Score

How Your Credit Score Is Calculated Wells Fargo

How Your Credit Score Is Calculated Wells Fargo

How Is My Credit Score Calculated The Motley Fool

How Is My Credit Score Calculated The Motley Fool

![]() How Credit Score Is Calculated By Equifax Experian Transunion Mybanktracker

How Credit Score Is Calculated By Equifax Experian Transunion Mybanktracker

How Your Credit Score Is Calculated

How Your Credit Score Is Calculated

How To Improve Your Credit Score Fast Experian

How To Improve Your Credit Score Fast Experian

How Are Fico Scores Calculated Myfico Myfico

How Are Fico Scores Calculated Myfico Myfico

Credit Score Southern Wesleyan University

Credit Score Southern Wesleyan University

Tips For Managing Your Credit Score Awardwallet Blog

Tips For Managing Your Credit Score Awardwallet Blog

Credit Score Breakdown Red Canoe Credit Union

Comments

Post a Comment