Featured

- Get link

- X

- Other Apps

What Is Considered Income For Affordable Care Act

Learn more about whos counted in a Marketplace household. For 2021 those making between 12760-51040 as an individual or 26200-104800 as a family of 4 qualify.

![]() The Sometimes Un Affordable Care Act Rochester Beaconrochester Beacon

The Sometimes Un Affordable Care Act Rochester Beaconrochester Beacon

Non-taxable Social Security benefits are counted as income for the Affordable Care Act and affect tax credits.

What is considered income for affordable care act. This includes disability payments SSDI but does not include Supplemental Security Income. Premium tax credits are a federal tax credit that lowers the premium amount that individuals must pay on monthly health insurance when purchased from the marketplace. The Affordable Care Act definition of MAGI under the Internal Revenue Code2 and federal Medicaid regulations3 is shown below.

Adjusted Gross Income AGI Tax-Exempt Interest Foreign Earned Income That Was Excluded From Your Tax Return Modified Adjusted Gross Income MAGI MAGI of Your Dependents Who Are Required To A Tax Return Household Income. A Silver Plan is used in the example where the insurer will pay for 70 of the medical expense. The Marketplace counts estimated income of all household members.

The Affordable Care Act is meant to reduce the cost of health insurance coverage for qualified but lower-income Americans by providing premium tax credits and cost-sharing reductions. The Pay Back Requirements For Underestimating Annual Income By Stephen Fishman JD. Under the Affordable Care Act eligibility for income-based Medicaid1 and subsidized health insurance through the Marketplaces is calculated using a households Modified Adjusted Gross Income MAGI.

You must be ineligible for health insurance coverage through an employer or government plan. For plan years beginning in 2016 employer-sponsored coverage will generally be considered affordable under both the pay or play rules and the premium tax credit eligibility rules if. The Affordable Care Act definition of MAGI under the Internal Revenue Code and federal Medicaid regulations is shown below.

Under the ACA in 2020 health plans are considered ACA affordable if the employees required contribution for individual coverage does not exceed 978 of the employees household income for the year. The Affordable Care Act ACA is the name for the comprehensive health care reform law and its amendments. Under the Affordable Care Act eligibility for income-based Medicaid and subsidized health insurance through the Marketplaces is calculated using a households Modified Adjusted Gross Income MAGI.

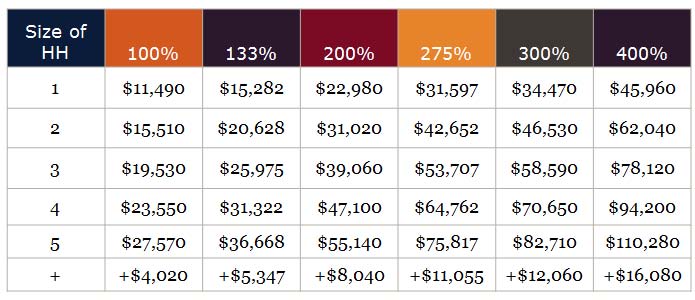

The premiums are made affordable by a premium subsidy in the form of a tax credit calculated off your income relative to the federal poverty levels FPL also known as HHS poverty guidelines. Withdrawals from a 401k plan are generally counted as income your pre-tax contributions an employers matching contributions as well as earnings are included in income. Your household income is used to determine whether youre eligible for a tax subsidy or for Medicaid so its a critical piece of information to have.

In addition to these income limits all of the following eligibility requirements apply. When you apply for health insurance through your Affordable Care Act health insurance exchange also called Obamacare you need to estimate what your family income. You qualify for the premium subsidy only if your modified adjusted gross income MAGI is at 400 FPL or below.

The Patient Protection and Affordable Care Act was signed into law on March 23 2010 and was amended by the Health Care and Education Reconciliation Act on March. Income determines costs assistance subsidies for tax credits cost-sharing reductions and Medicaid and CHIP eligibility. They limit the amount you pay in monthly premiums to a percentage of your annual income.

Premium expense is capped at 95 of income and out of pocket expense excluding premium expense ranges from 6350 for a single individual up to 12700 for a family of four. The minimum income required to participate in Obamacare benefits is 100 percent of the federal poverty level. The law was enacted in two parts.

Household income is the modified adjusted gross income of the employee and any spouse or dependents he or she may have. Obamacare offers subsidies also known as tax credits that work on a sliding scale. Employees monthly household income 2333 about 28000 per year 983 of the employees monthly household income 229 Monthly cost to the employee of the lowest-priced plan the employer offers for self-only coverage 275.

Most people are eligible for subsidies when they earn 400 or less of the federal poverty level. When applying for an insurance plan through the health insurance Marketplaces set up under the Affordable Care Act youll be asked to project your income for 2014. Affordable Care Act Tax Credits.

But qualified distributions from a designated Roth account in a 401k plan are not considered income. The law addresses health insurance coverage health care costs and preventive care. Individuals and families whose modified adjusted gross income is between 100 and 400 of the federal poverty level generally qualify for the subsidy.

20 rader Whose income to include in your estimate For most people a household consists of the tax filer their spouse if they have one and their tax dependents including those who dont need coverage. For 2020 coverage those making between 12490-49960as an individual or 25750-103000 as a family of 4 qualify for ObamaCare.

Will You Have To Pay Obamacare Taxes This Year

Will You Have To Pay Obamacare Taxes This Year

:max_bytes(150000):strip_icc()/how-much-will-obamacare-cost-me-3306054-v3-5bbd183246e0fb0051d2593b.png) How Much Will Obamacare Cost Me

How Much Will Obamacare Cost Me

What Counts As Income When You Re Enrolling In Health Insurance Pennsylvania Health Access Network

What Counts As Income When You Re Enrolling In Health Insurance Pennsylvania Health Access Network

Modified Adjusted Gross Income Magi

Modified Adjusted Gross Income Magi

Obamacare And The Affordable Care Act

Obamacare And The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

Modified Adjusted Gross Income Under The Affordable Care Act Updated With Information For Covid 19 Policies Uc Berkeley Labor Center

Modified Adjusted Gross Income Under The Affordable Care Act Updated With Information For Covid 19 Policies Uc Berkeley Labor Center

2021 Obamacare Subsidy Calculator Healthinsurance Org

2021 Obamacare Subsidy Calculator Healthinsurance Org

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

Unemployed On Obamacare Does Withdrawls From My Ira Or 401k Count As Income Healthtn

Unemployed On Obamacare Does Withdrawls From My Ira Or 401k Count As Income Healthtn

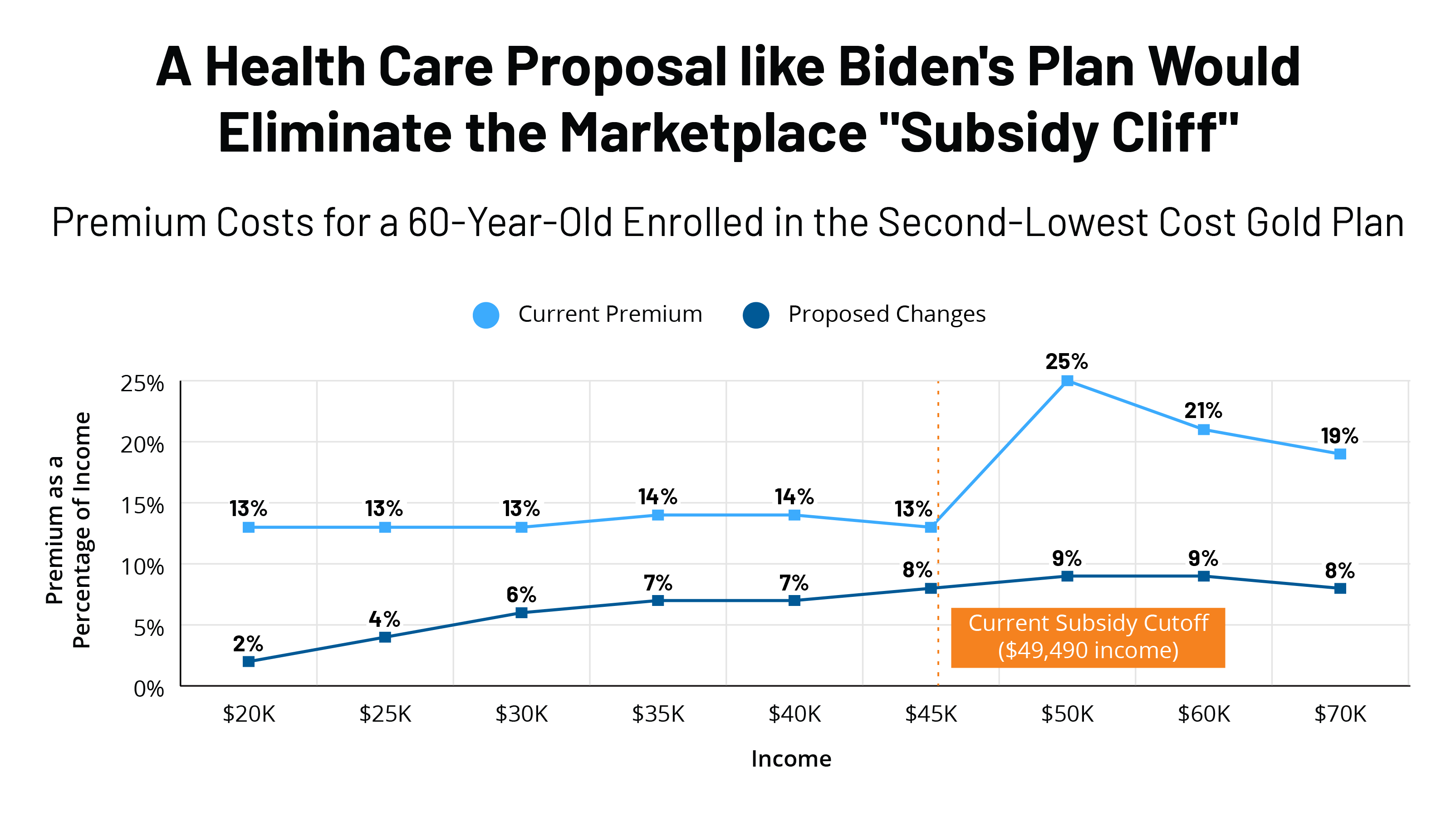

Affordability In The Aca Marketplace Under A Proposal Like Joe Biden S Health Plan Kff

Affordability In The Aca Marketplace Under A Proposal Like Joe Biden S Health Plan Kff

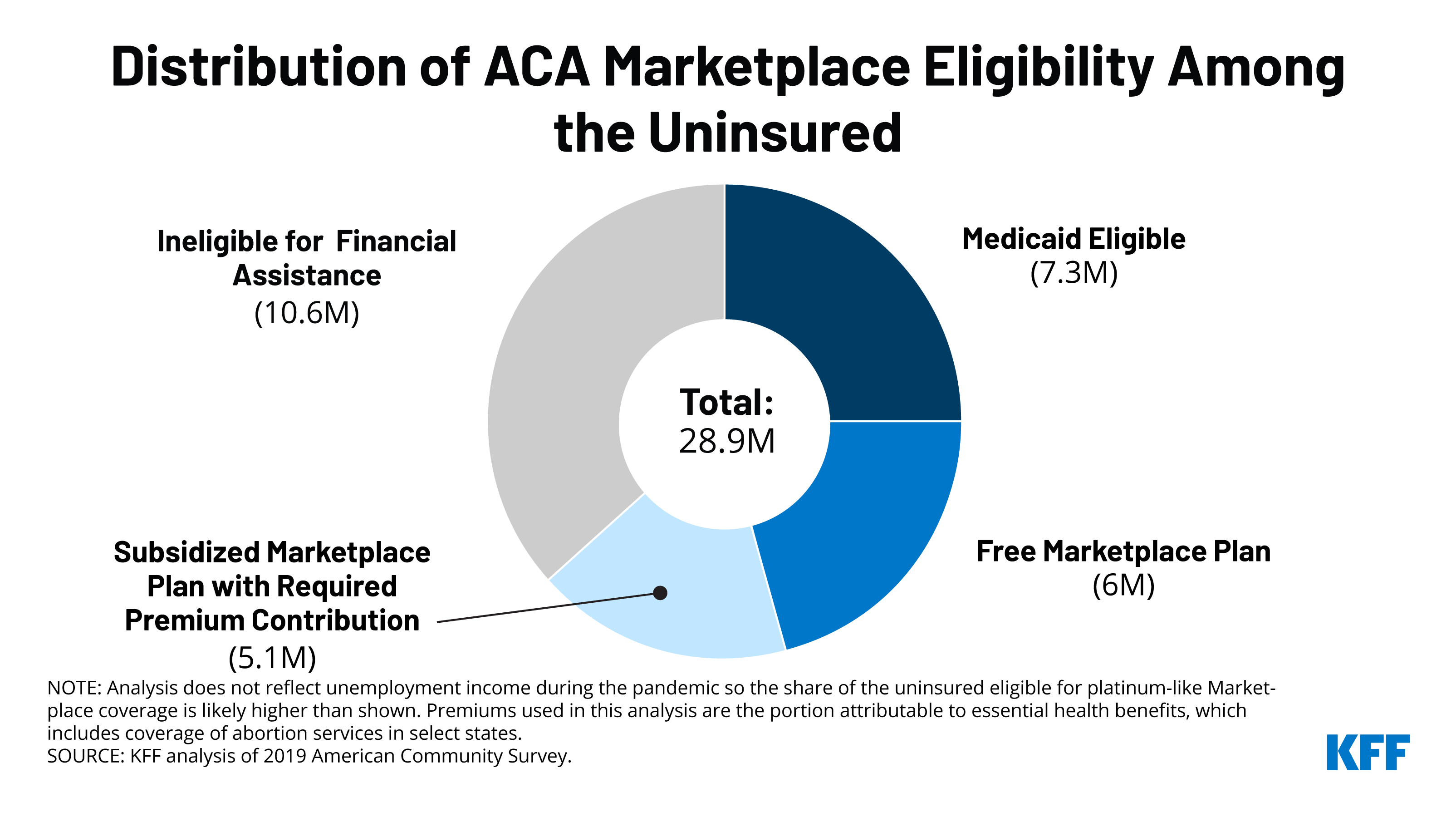

How The American Rescue Plan Act Affects Subsidies For Marketplace Shoppers And People Who Are Uninsured Kff

How The American Rescue Plan Act Affects Subsidies For Marketplace Shoppers And People Who Are Uninsured Kff

Tax Implications Of The Affordable Care Act Wealth Enhancement Group

Tax Implications Of The Affordable Care Act Wealth Enhancement Group

Vitatce Basic Certification Topics On Affordable Care Act

Vitatce Basic Certification Topics On Affordable Care Act

Comments

Post a Comment