Featured

- Get link

- X

- Other Apps

The Concepts Of Return On Investment And Risk

Suppose the chance of total loss is 1 and the chance of a 15 return is 99. Imagine for the sake of illustration that theres no middle ground.

(77).jpg) Concept Of Risk And Return Finance Quiz Proprofs Quiz

Concept Of Risk And Return Finance Quiz Proprofs Quiz

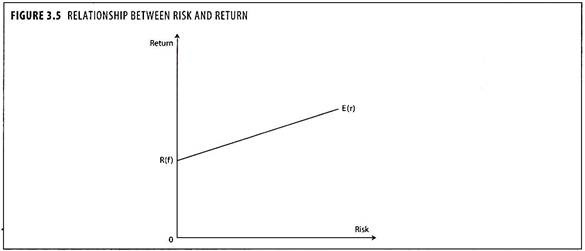

Increased potential returns on investment usually go hand-in-hand with increased risk.

/AchieveOptimalAssetAllocation-02-0e9eaa2219934b4cb85c48fb9db7b45c.png)

The concepts of return on investment and risk. The risk associated with investing in this stock can. Ther return 15 on your investment or become valueless resulting in a total loss of your money. ROI Net Profit Total Investment 100.

To calculate the return on this investment divide the net profits 1200 - 1000 200 by the investment cost 1000 for a ROI of 2001000 or 20. You either make 15 or lose everything. Risk aversion is a concept based on the behavior of firms and investors while exposed to uncertainty to attempt to reduce that uncertainty.

The formula for calculating the expected return of an asset given its risk is as follows. Return from equity comprises dividend and capital appreciation. R f Risk-free rate.

Dealing with the return to be achieved requires estimate of the return on investment over the time period. The risk and return constitute the framework for taking investment decision. Ad Open A Low Cost Easy-To-Use Investment Account In Minutes.

Return refers to either gains and losses made from trading a security. Typically the more risk you would take on an investment the more ample the reward will be if the investment turns out to be a winner. Gains and losses do not balance out with percentages.

β i Beta of the investment. ER i R f β i ER m R f ER i Expected return of investment. Risk is associated with the possibility that realized returns will be less than the returns that were expected.

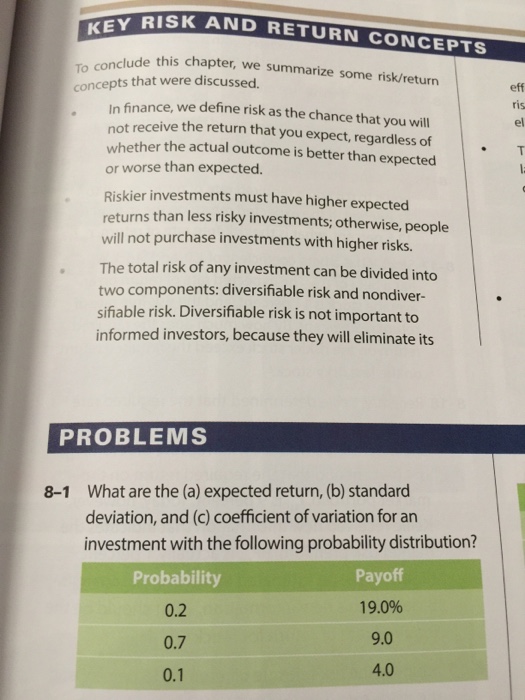

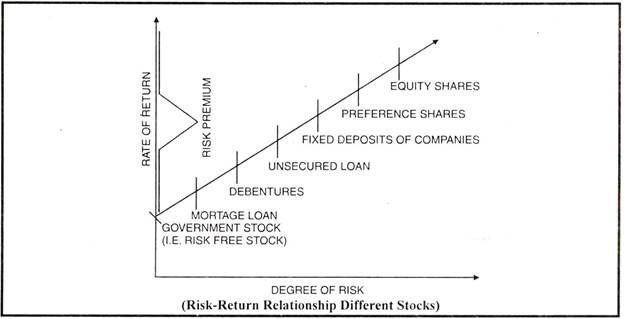

Rate of return is the simple concept of calculating the gain earned during the entire period of investment expressed in percentage. Different types of risks include project-specific risk industry-specific risk competitive risk international risk and market risk. The Concepts of Return on Investment Risk Return on Investment ROI.

In fact all investments carry with them a financial risk which can be mitigated by diversifying your investment portfolio rather than putting all your eggs in one basket. To earn return on investment that is to earn dividend and to get capital appreciation investment has to be made for some period which in turn implies passage of time. Risk is the variability in the expected return from a project.

Defined from a financial perspective risk is the chance that your expectations of the investment will not match the results for instance you always risk losing a portion or even all of your finances even when you back the right investment. ER m Expected return of market ER m R f Market risk premium. Return on investment or ROI is the ratio of a profit or loss made in a fiscal year expressed in terms of an investment and shown as a percentage of increase or decrease in the value of the investment during the year in question.

For example 1000 invested has a. Grasping the concepts of return on investment and risk in real estate is an important skill to acquire early in your investment career. Understanding Basic Risk and Return on Investment.

The Concepts of Return on Investment Risk. Risk aversion also plays an important role in determining a firms required return on an investment. Ad Whisky named as the best performing collectable of the decade.

You will learn about the risk reward ratio and how to apply it towards investment decision-making. You must also examine. When you invest in your business or put your profits into an investment vehicle you can determine what your potential return is.

In other words it is the degree of deviation from expected return. The basic formula for ROI is. In this lesson youll learn more about the concept of risk and return.

In investing risk and return are highly correlated. While data metrics and calculations should be your ultimate guide it cant hurt to start with a basic foundation for assessing risk-return trade-off. With this information one could.

The term refers to how much money is gained or lost after an investment. This possibility of variation of the actual return from the expected return is termed as risk.

Avant Investment Concepts And Your Risk Profile

Avant Investment Concepts And Your Risk Profile

:max_bytes(150000):strip_icc()/CapitalAssetPricingModelCAPM1_2-e6be6eb7968d4719872fe0bcdc9b8685.png) Capital Asset Pricing Model Capm

Capital Asset Pricing Model Capm

/AchieveOptimalAssetAllocation-02-0e9eaa2219934b4cb85c48fb9db7b45c.png) Determining Risk And The Risk Pyramid

Determining Risk And The Risk Pyramid

Https Www Motilaloswal Com Blog Details Understand Your Risk Return Trade Off Before Investing In Equities 1844

Articles Junction Concept Of Risk And Return With Diagram

Articles Junction Concept Of Risk And Return With Diagram

Chart Explaining The Investing Concept Of Risk And Return Blog

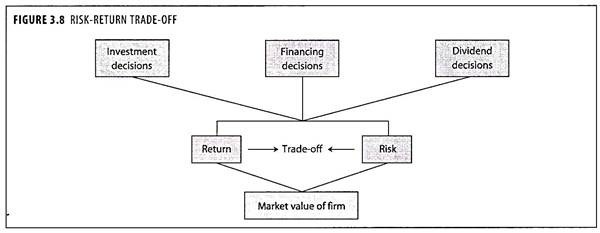

Risk And Return On Investment Firm Financial Management

Risk And Return On Investment Firm Financial Management

:max_bytes(150000):strip_icc()/AchieveOptimalAssetAllocation-02-0e9eaa2219934b4cb85c48fb9db7b45c.png) Determining Risk And The Risk Pyramid

Determining Risk And The Risk Pyramid

Investment Concepts Tilea Wealth

Investment Concepts Tilea Wealth

Simplifying The Concepts Of Return On Investment And Risk Kcb Bank Kenya Ltd

Simplifying The Concepts Of Return On Investment And Risk Kcb Bank Kenya Ltd

Risk And Return On Investment Firm Financial Management

Risk And Return On Investment Firm Financial Management

:max_bytes(150000):strip_icc()/dotdash_Final_Risk_Feb_2020-01-66f3c5ffb3c040848f1708091fa40eb9.jpg)

Comments

Post a Comment