Featured

Federal Income Tax Extension Form

A tax extension gives you an additional 6 months to file your tax return making your new deadline October 15. If you cant file your federal income tax return by the due date you may be able to get a six-month extension from the Internal Revenue Service IRS.

Https Www Irs Gov Pub Irs Pdf F4868 Pdf

This extension is for six months and applies only to filing.

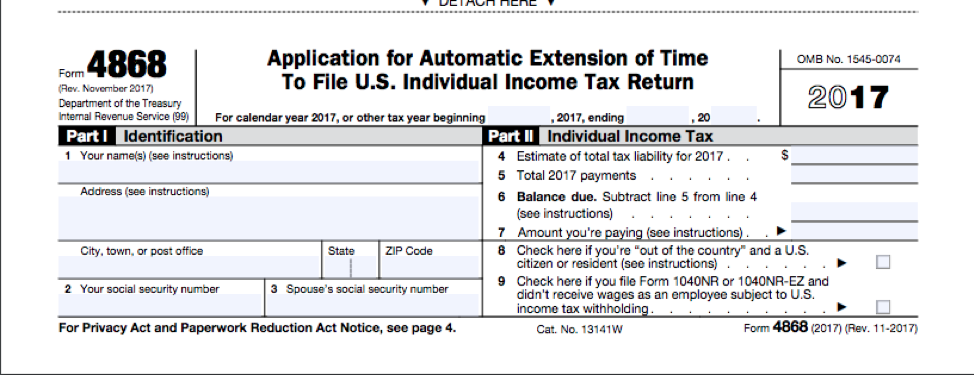

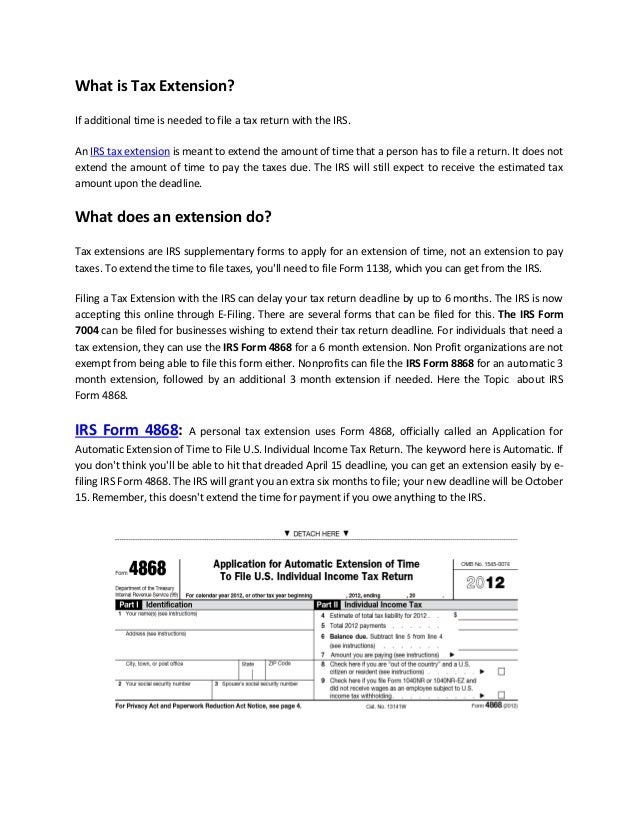

Federal income tax extension form. Application for Extension of Time to File US. Then complete and file your return on or before October 15 2021. IRS Tax Extension Form 4868 Individuals If You Cannot File Your Taxes on Time IRS Form 4868 is an Application to Get a 6-Month Extension on Your Tax Filing.

Estate and Generation-Skipping Transfer Taxes PDF. Citizen or resident files this form to request an automatic extension of time to file a US. Form 4768 Application for Extension of Time to File a Return andor Pay US.

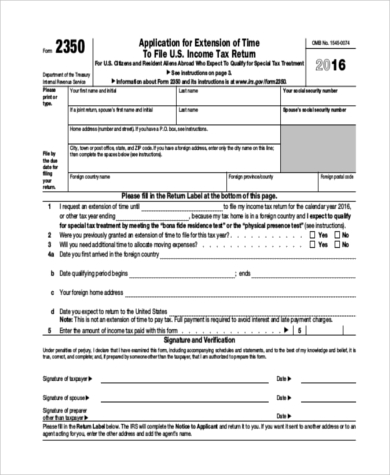

Form 2350 Application for Extension of Time to File US. Form 5558 Application for Extension of Time to File Certain Employee Plan Returns PDF. To avoid possible penalties estimate and pay the taxes you owe by the tax deadline of April 15.

Form 4868 is used by individuals to apply for six 6 more months to file Form 1040 1040NR or 1040NR-EZ. Citizens and Resident Aliens Abroad Who Expect To Qualify for Special Tax Treatment PDF. If you cannot file on time you can request an automatic extension of time to file the following forms.

You owe taxes for the current tax year. Individual income tax return. This does not grant you more time to pay your taxes.

Payment of the expected tax due is required with Form PV by April 15 2021. Your federal taxes are still due on May 17 so if you dont pay them by then you will incur penalties and interest. You can file and pay by credit card or electronic funds withdrawal direct debit on our Web site.

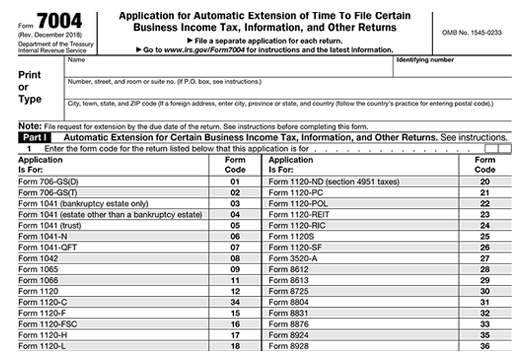

Use Form 7004 to request an automatic 6-month extension of time to file certain business income tax information and other returns. Information on e-filing Form 7004. File one of these forms.

Income Tax Return 2020 09092020 Form 2350 SP. Form 1 Form 1-NRPY Form 2. Box 1302 Charlotte NC 28201-1302 USA.

A taxpayer who is not granted an automatic extension to file a federal income tax return must file Form D-410 Application for Extension for Filing Individual Income Tax Return by the original due date of the return in order to receive an extension for North Carolina income tax purposes. Do you have a question. Income Tax Return For US.

Form IT-201 Resident Income Tax Return. And want to pay by mail send Form 4868 with your payment to the. Citizen or resident files this form to request an automatic extension of time to file a US.

However in most cases this extension does not. All other Form 1040NR 1040NR-EZ 1040-PR and 1040-SS filers. An extension of time to file the federal return automatically extends the time to file the Michigan return to the new federal due date.

Generally you automatically get a 6-month extension to file your Massachusetts income tax return as long as youve paid at least 80 of the total amount of tax due on or before the due date and youre filing. If you owe federal taxes include your estimated payment with your Form 4868 and mail itpostmarked by May 17 2021 to avoid any penalties or interest. Obtaining an extension will prevent you from being subject to often very large failure-to-file penalties.

The IRS and most states will grant an automatic 6-month extension of time to file income tax and other types of tax returns which can be obtained by filing the proper extension request form. But if you need more time you will need to file for an extension with Form 4868. Do you need to request a state tax extension.

It is not an extension of time to pay your tax bill. About Form 7004 Application for Automatic Extension of Time To File Certain Business Income Tax Information and Other Returns. Individual income tax return.

Form 4868 is a Federal Individual Income Tax form. Individual and Fiduciary filers submit Form 4 or a copy of your federal extension. Will you be ready to file your annual Federal income tax return by the proper deadline typically April 15.

Use an Automatic Extension form to make a payment if both of the following apply. Form IT-203 Nonresident and Part-Year Resident Income Tax Return. Box 1303 Charlotte NC 28201-1303 USA.

Kansas City MO 64999-0045 USA. All foreign estate and trust Form 1040NR filers. If no tax is due and you requested a federal extension you do not need to file Form PV or take any other action to obtain an automatic six month extension.

State tax extension guidelines vary. The extension of the federal income tax filing and payment deadline to May 17 is completely automatic. More In Forms and Instructions.

Extension of Time For Payment of Taxes By a Corporation Expecting a Net Operating Loss Carryback 1118 11292018 Form 2350. Composite filers must submit Form 4 even if a federal extension was filed. You cannot file your tax return by the original due date.

For business entities that are not corporations we automatically allow a 7-month extension.

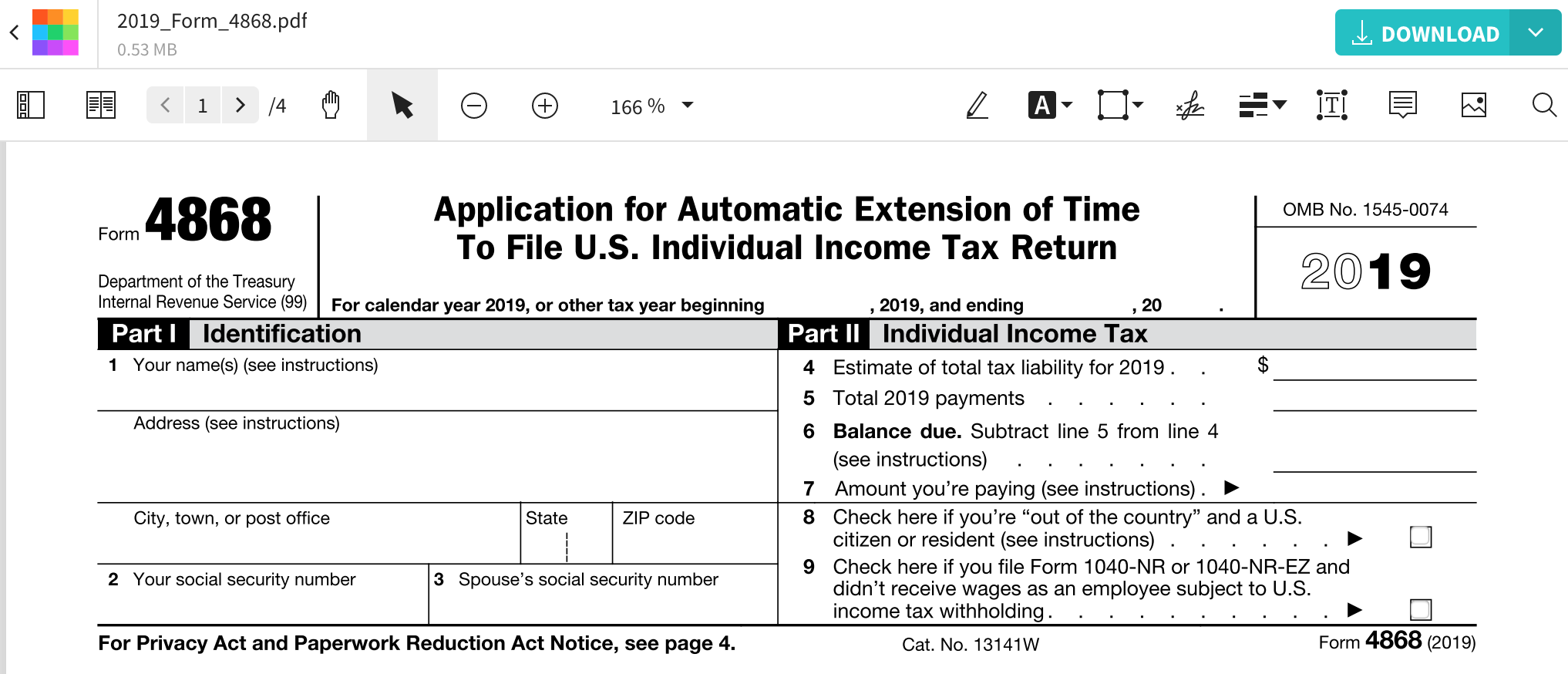

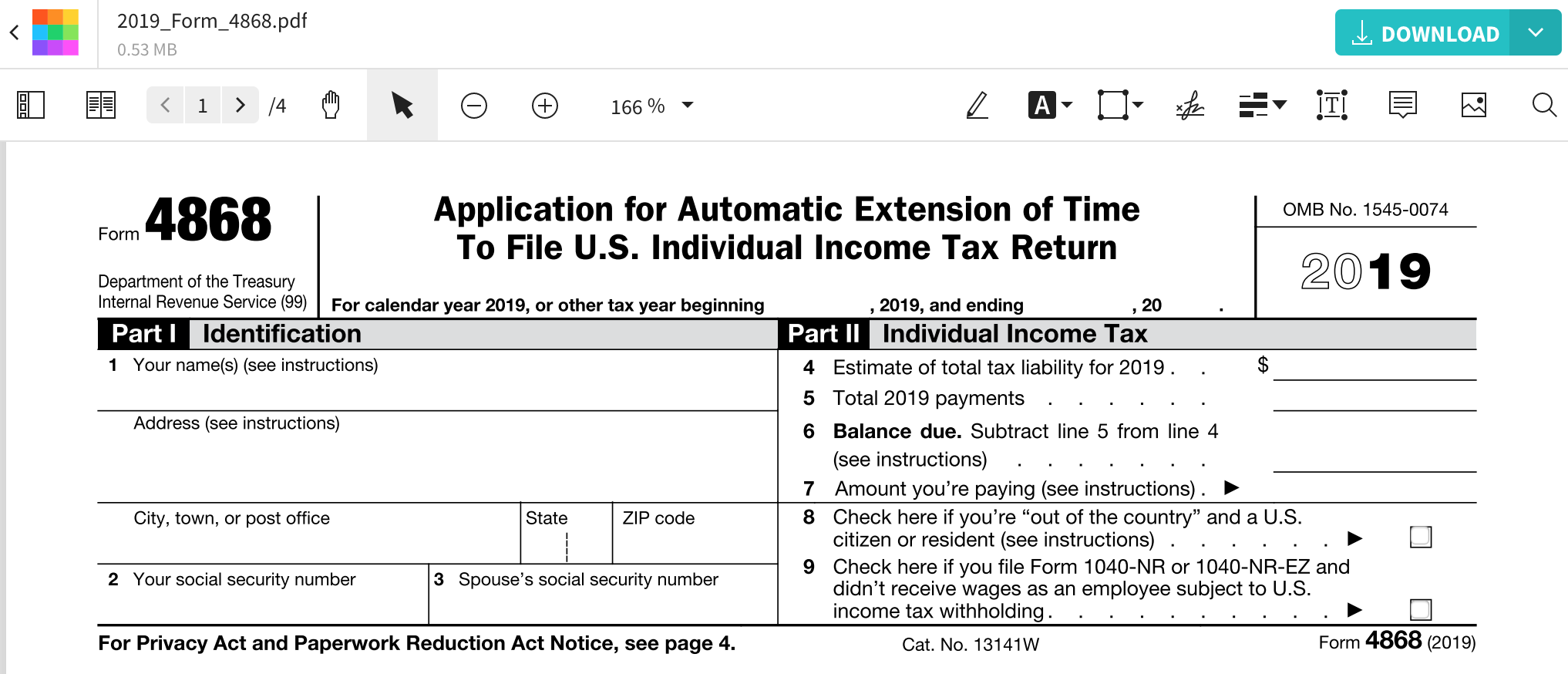

E File An Irs Tax Extension E File Com

E File An Irs Tax Extension E File Com

Form 4868 Fill Irs Extension Form Online For Free Smallpdf

Form 4868 Fill Irs Extension Form Online For Free Smallpdf

Learn How To Fill The Form 4868 Application For Extension Of Time To File U S Income Tax Return Youtube

Learn How To Fill The Form 4868 Application For Extension Of Time To File U S Income Tax Return Youtube

File An Extension For Your Federal Tax Return Raleigh Cpa

File An Extension For Your Federal Tax Return Raleigh Cpa

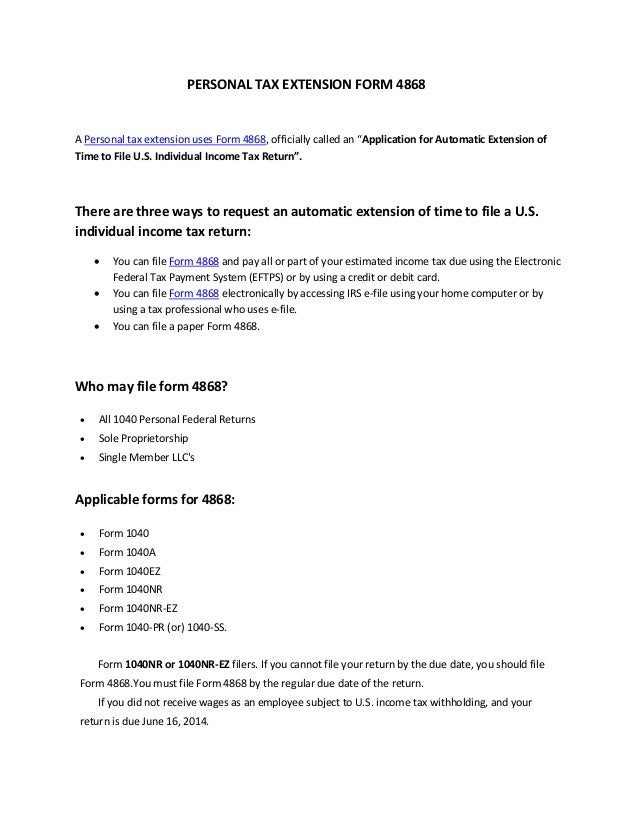

Personal Tax Extension Form 4868

Personal Tax Extension Form 4868

Form 4868 Fill Irs Extension Form Online For Free Smallpdf

Form 4868 Fill Irs Extension Form Online For Free Smallpdf

Free 7 Sample Income Tax Extension Forms In Pdf Ms Word

Free 7 Sample Income Tax Extension Forms In Pdf Ms Word

Tax Extension Form Extend Tax Due Date If You Need

Tax Extension Form Extend Tax Due Date If You Need

How To File For A Business Tax Extension Federal Bench Accounting

How To File For A Business Tax Extension Federal Bench Accounting

Printable Irs Form 4868 Income Tax Extension Tax Year 2017 For Filing In 2018 Tax Season Cpa Practice Advisor

Printable Irs Form 4868 Income Tax Extension Tax Year 2017 For Filing In 2018 Tax Season Cpa Practice Advisor

:max_bytes(150000):strip_icc()/Screenshot43-d22959eda68841df96f3e8f1bb223a34.png)

Comments

Post a Comment