Featured

Do You Lose Equity When Refinancing

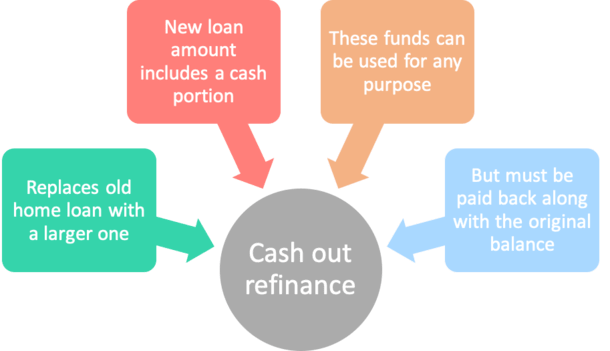

If you do a cash-out refinance however your equity will drop. This could mean that youll have negative equity right away on the new vehicle youre getting into.

What Is A Cash Out Refinance The Truth About Mortgage

What Is A Cash Out Refinance The Truth About Mortgage

Refinancing With Less Than 20 Equity.

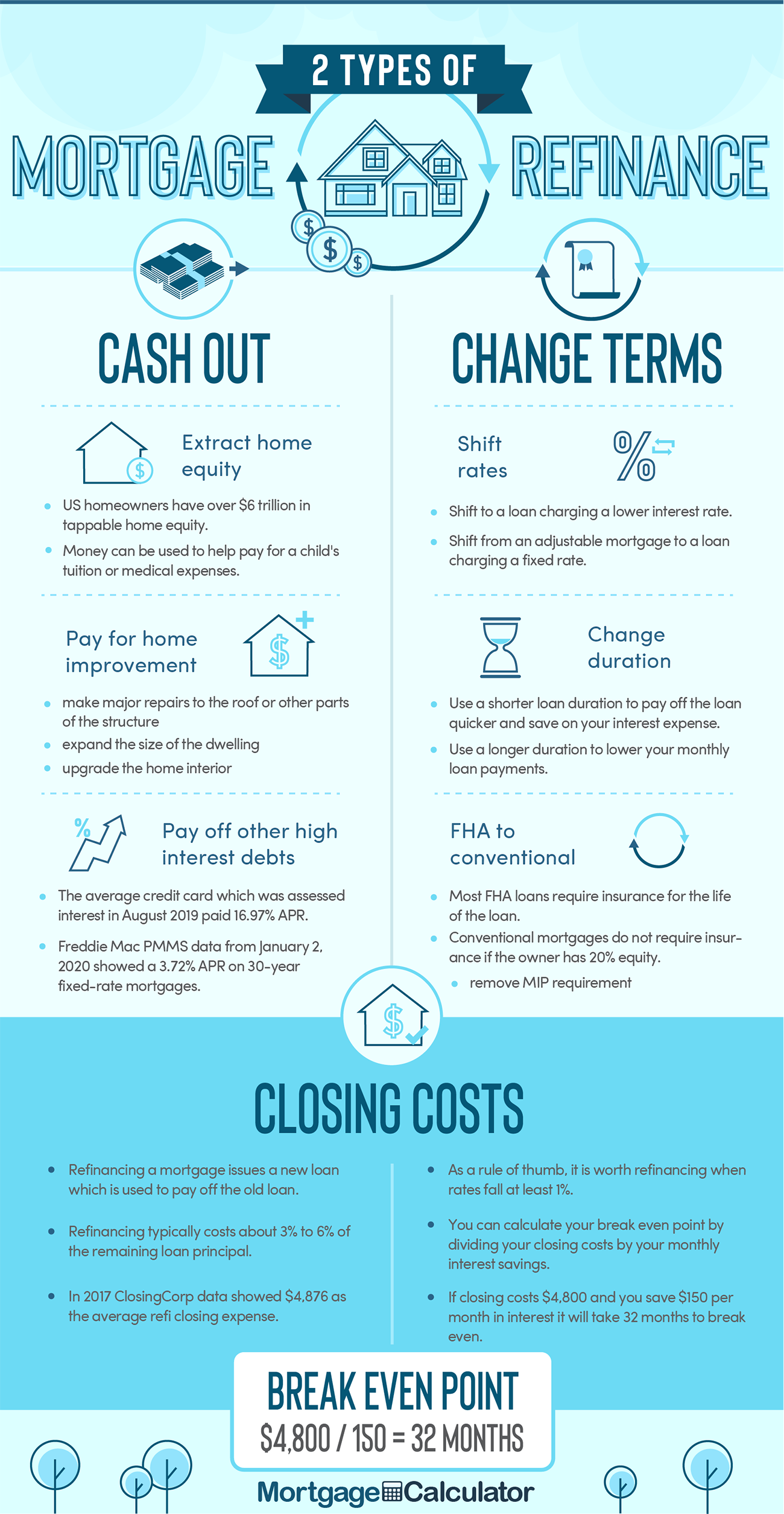

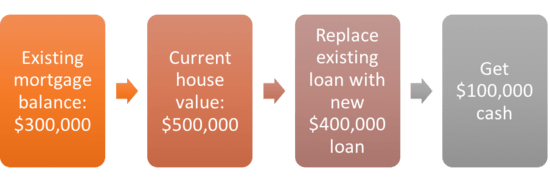

Do you lose equity when refinancing. While it may be possible to refinance a car that you owe too much money on you should consider your options carefully before doing so. If the closing costs on your refinancing are 5000 and you dont want to pay those costs at closing the lender can loan you 155000 and youve reduced your equity position in the home by 5000. That house that you bought for 300000 and then appraised for 305000 has enough equity to let you cash out a bit and refinance your old mortgage.

Taking cash-back refinances could impact your tax bill when you sell your property. You will need to have 10 to 20 equity left after the refinance. The percentage required depends on the lender and whether youre willing to pay for.

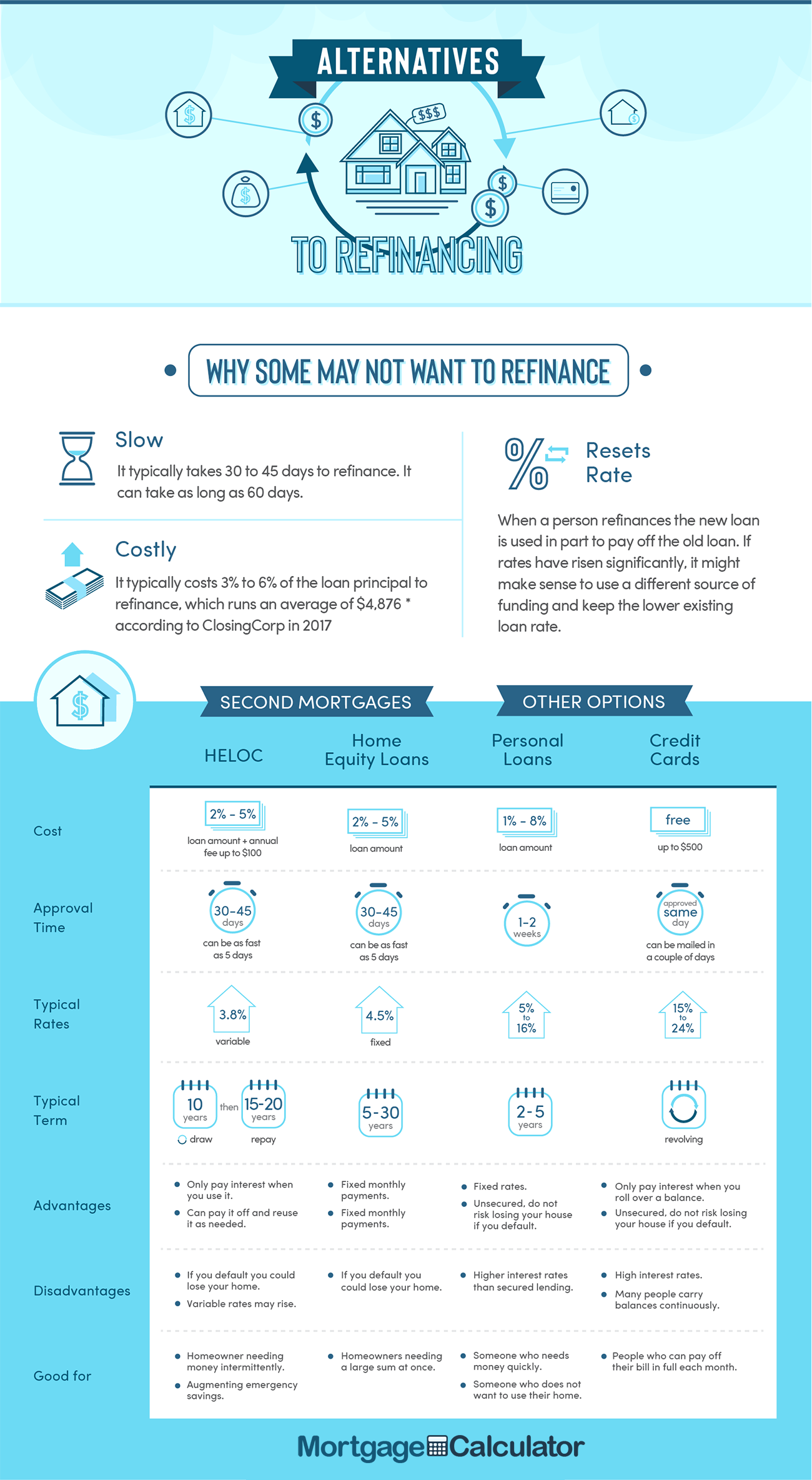

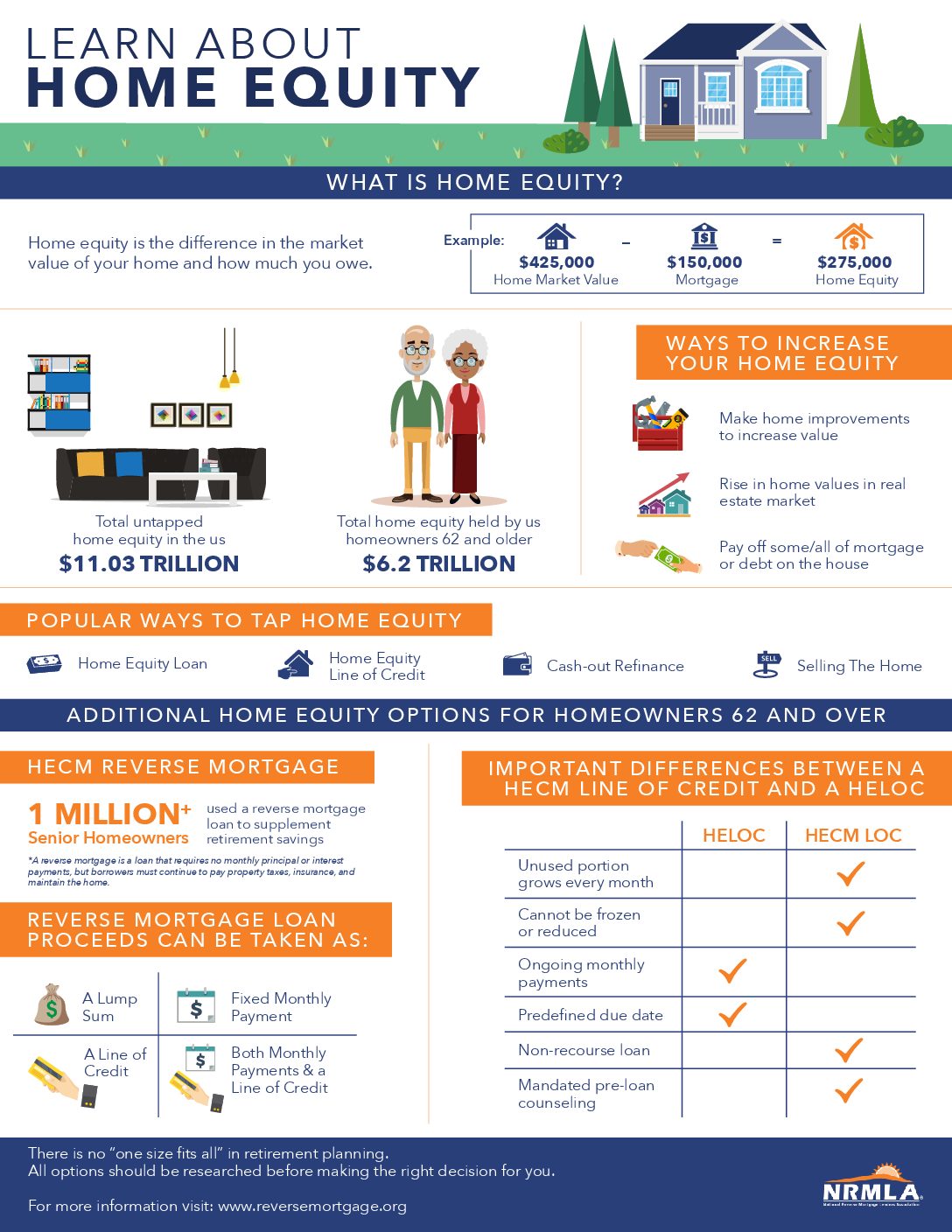

In addition refinancing with a home equity loan allows you the opportunity to get funds from your home to use for many purposes. If the closing costs on your refinancing are 5000 and you dont want to pay those costs at closing the lender can loan you 155000 and youve reduced your equity position in the home by. That should send up a red flag for you as the borrower.

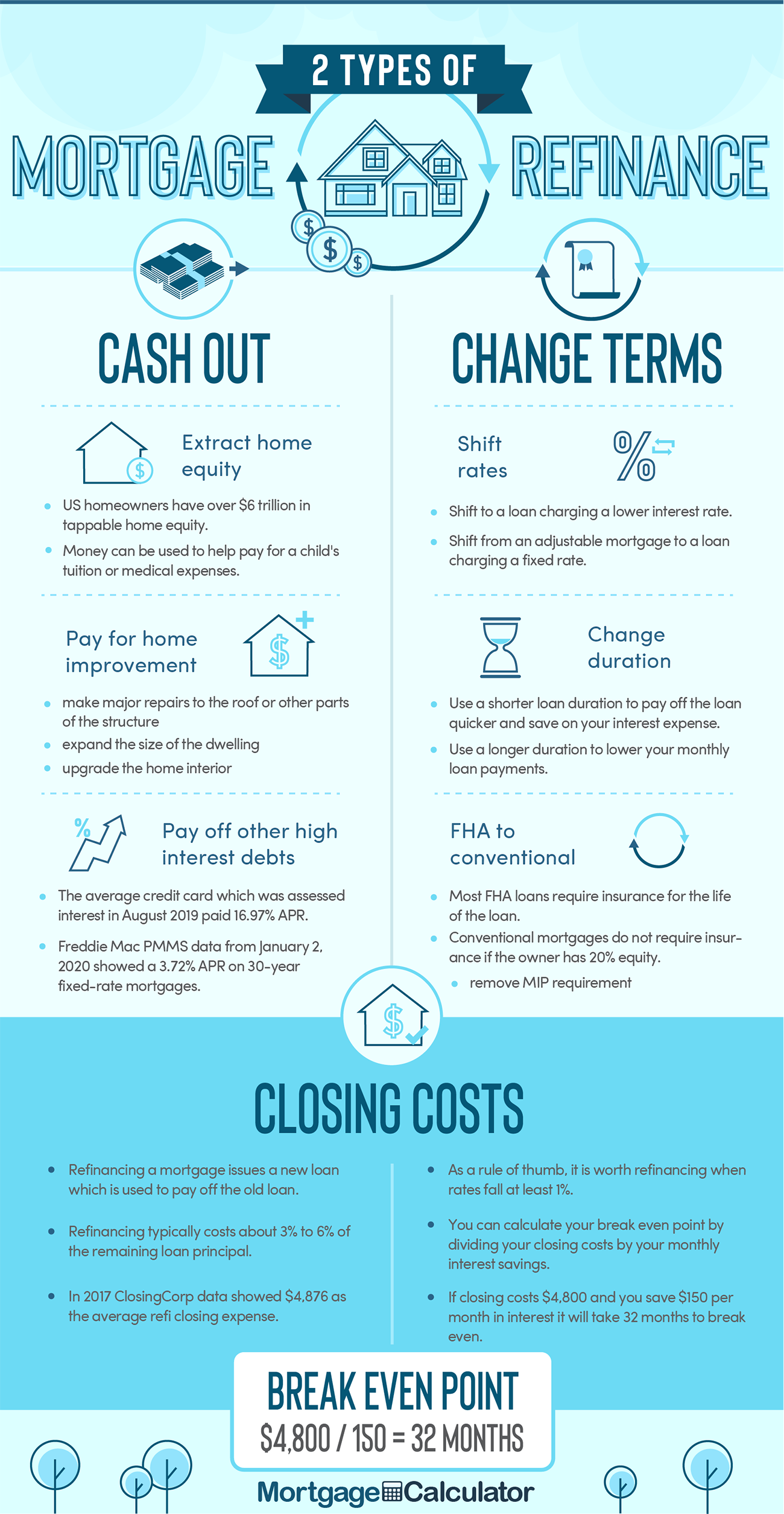

This means taking out a new loan with a lower interest rate which should lower the monthly payment. Traditional refinancing can require thousands of dollars at closing. Like cash-out refinancing a home equity loan is another way to borrow against what you have paid off on your mortgage.

For Some Looking to Refinance an Appraisal Could Pose an Untimely Pitfall. 5 That means when you take out a home equity loan you are losing some of your equity in the home. This also means you generally need a loan-to-value LTV ratio of no.

Your equity shrinks while your financed loans get bigger. The lender will let you borrow up to 85 percent of the value of your home or 259250. The Costs of Refinancing Refinancing a home usually costs between 3 and 6 of the total loan amount but borrowers can find several ways to reduce the costs or wrap them into the loan.

As mentioned some HELs dont require cash at closing which can represent significant savings and you can put more towards the principal amount. Therefore you normally retain at least 20 percent of your equity even after a cash-out refinance. Refinancing can increase your mortgage costs if you havent built up sufficient equity in your home.

Lenders use a calculation called simple interest amortization to determine how much of each monthly payment goes toward interest and how much goes toward paying down your principal balance. Youre looking to cash out and refinance. With a home equity loan like at Discover Home Loans there is no cash due at closing.

When your new loan closes part of the proceeds will go toward. The IRS lets you sell your home and pocket up to 500000 in gains tax-free if youre married and 250000 if. If youre looking to refinance your mortgage for a lower rate different loan terms or to get cash out of your home to use for any expenses a home equity loan refinance may be for you.

For conventional refinances youll need at least 20 percent equity in your home to avoid private mortgage insurance or PMI. Lower interest rates have sparked a refinancing boom and plenty of homeowners are leveraging their home equity to borrow at low rates to consolidate high. Deferred Maintenance Will Cause You to Lose Equity.

The equity that you built up in your home over the years whether through principal repayment or price appreciation remains yours even if you refinance the home. Refinancing your mortgage restarts your amortization from scratch which lenders love. A cash-out refi of your loan can be a good way to refinance a home equity loan if you also want to refinance your first mortgage.

A refinance can simply mean trading for a new loan or cashing out some of the equity you already have in the property. Generally when you have less than 20 equity value the lender will require you to pay private mortgage insurance premiums.

Refinancing A Home Equity Loan What You Need To Know Credible

Refinancing A Home Equity Loan What You Need To Know Credible

/GettyImages-155420417-0636da199f484064a9ac1e7af2b84012.jpg) 7 Bad Reasons To Refinance Your Mortgage

7 Bad Reasons To Refinance Your Mortgage

Do I Lose My Home S Equity After Refinancing Fox Business

Do I Lose My Home S Equity After Refinancing Fox Business

Should I Refinance My Home Loan Banksa

Should I Refinance My Home Loan Banksa

Heloc Home Equity Line Of Credit Faqs Nerdwallet

Heloc Home Equity Line Of Credit Faqs Nerdwallet

Should I Refinance My Mortgage Beginner S Guide To Refinancing Your Home Loan

Should I Refinance My Mortgage Beginner S Guide To Refinancing Your Home Loan

How A Student Loan Cash Out Refinance Works For Homeowners Student Loan Hero

How A Student Loan Cash Out Refinance Works For Homeowners Student Loan Hero

What Is Home Equity Reverse Mortgage

What Is Home Equity Reverse Mortgage

Refinancing A Home Equity Loan Bankrate

Refinancing A Home Equity Loan Bankrate

Ways To Use Your Home S Equity For Financing Life Goals

Ways To Use Your Home S Equity For Financing Life Goals

Should I Refinance My Mortgage Beginner S Guide To Refinancing Your Home Loan

Should I Refinance My Mortgage Beginner S Guide To Refinancing Your Home Loan

What Is The Difference Between Cash Out Refinance Vs Heloc

What Is A Cash Out Refinance The Truth About Mortgage

What Is A Cash Out Refinance The Truth About Mortgage

/what-is-refinancing-315633-final-5c94f0874cedfd0001f16988.png)

Comments

Post a Comment