Featured

What Tax Year Are We Filing For In 2020

Get A 100 Accuracy Guarantee With HR Block for your US. That threshold was set to increase from 75 to 10 in 2020 but the reduction was permanently passed.

Tax Changes And Key Amounts For The 2020 Tax Year Kiplinger

Tax Changes And Key Amounts For The 2020 Tax Year Kiplinger

31 when you earned income had taxes withheld from your pay as an employee paid in quarterly estimated taxes if youre self-employed or made tax-deductible expenditures.

What tax year are we filing for in 2020. 2020 Tax Return Forms and Schedules - January 1 - December 31 2020 - can be e-Filed now. In 2020 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1. Otherwise late filing penalties might.

Due to the COVID-19 pandemic the federal government extended this years federal income tax filing deadline from April 15 2021 to May 17 2021. The 2020 federal income tax filing deadline for individuals has been extended from April 15 2021 to May 17 2021. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of 518400 and higher for single filers and 622050 and higher for married couples filing jointly.

After that youll have 7 to 10 months to prepare your tax return. The standard deduction for married filing jointly rises to 24800 for tax year 2020 up 400 from the prior year. A 52-53-week tax year is a fiscal tax year that varies from 52 to 53 weeks but does not have to end on the last day of a month.

Anzeige Trust The Experts At HR Block To Guide You Step By Step Through Your Expat Taxes. 13851 to 52850. Married Filing Jointly or Qualifying Widow.

Up to 9700. The term tax year refers to the calendar year for most individual taxpayersthe 12 months from Jan. The tax year for individuals.

Your state tax deadline may not be. Up to 13850. Up to 9700.

9701 to 39475. This rate is in effect for individual taxpayers filing as single with income greater than 518400 in 2020 and 523600 in 2021. 9701 to 39475.

Calendar year - 12 consecutive months beginning January 1 and ending December 31. UK tax year dates. You have until October 15 2021 to e-File 2020 Tax Returns however if you owe Taxes you should at least e-File a Tax Extension by April 15 2021.

So if you owe taxes for 2020 you have until May 17 2021 to pay them without interest or penalties. When the new year starts and what is changing for you The Chancellor announced in the 2020 Budget that the National Insurance Contribution thresholds in the new tax year. Tax year 202021 dates.

52851 to 84200. WASHINGTON The Treasury Department and Internal Revenue Service announced today that the federal income tax filing due date for individuals for the 2020 tax year will be automatically extended from April 15 2021 to May 17 2021. For tax years beginning in 2020 volunteer firefighters and volunteer medical responders will be able to exclude payments provided by state and local governments for performing emergency response from their income.

This extension is automatic and applies to filing and payments. 19401 to 78950. Get A 100 Accuracy Guarantee With HR Block for your US.

For tax years 2020 and 2021 the top tax rate remains 37. Payment can be delayed to the same date. The IRS will be providing formal guidance in the coming days.

Its the year preceding the typical April 15th deadline for filing your tax return. The tax years you can use are. Anzeige Trust The Experts At HR Block To Guide You Step By Step Through Your Expat Taxes.

The tax year 2020 adjustments generally are used on tax returns filed in 2021. 39476 to 84200. The tax items for tax year 2020 of greatest interest to most taxpayers include the following dollar amounts.

April 6th to April 5th. Self Assessment registration you can do it here. Fiscal year - 12 consecutive months ending on the last day of any month except December.

Unless you choose to file for an extension see question below you must file and pay any remaining federal income taxes you owe for 2020 by May 17. Here are the dates that you need to remember. The self-employment tax is 153 in 2019 and anyone who paid that full tax can then deduct half of it on their 2019 taxes.

Normally employees pay a tax of 765 on their income FICA taxes. 2020 Federal Income Tax Brackets and Rates. Up to 19400.

Taxfix On Twitter Millions Of People Were Put On Short Time Work Kurzarbeit Or Lost Their Jobs Last Year Making 2020 Taxfiling Mandatory For Them We Want To Help We Re Offering Free Tax Filing

Taxfix On Twitter Millions Of People Were Put On Short Time Work Kurzarbeit Or Lost Their Jobs Last Year Making 2020 Taxfiling Mandatory For Them We Want To Help We Re Offering Free Tax Filing

2020 Us Tax Calendar Dsv Digital We Find The Right Fit Between Expats And Accountants

2020 Us Tax Calendar Dsv Digital We Find The Right Fit Between Expats And Accountants

Fact Check Irs Moved 2020 Tax Filing Deadline To May 17

Fact Check Irs Moved 2020 Tax Filing Deadline To May 17

Your Bullsh T Free Guide To Taxes In Germany

Your Bullsh T Free Guide To Taxes In Germany

Your Bullsh T Free Guide To Taxes In Germany

Your Bullsh T Free Guide To Taxes In Germany

Federal Income Tax Deadlines In 2021

Federal Income Tax Deadlines In 2021

Updated 2020 Tax Filing Deadlines Milikowsky Tax Law

Updated 2020 Tax Filing Deadlines Milikowsky Tax Law

Experts Say Filing Your 2020 Taxes Might Be Complicated 5newsonline Com

Experts Say Filing Your 2020 Taxes Might Be Complicated 5newsonline Com

2020 Taxes Everything You Need To Know About Filing This Year

2020 Taxes Everything You Need To Know About Filing This Year

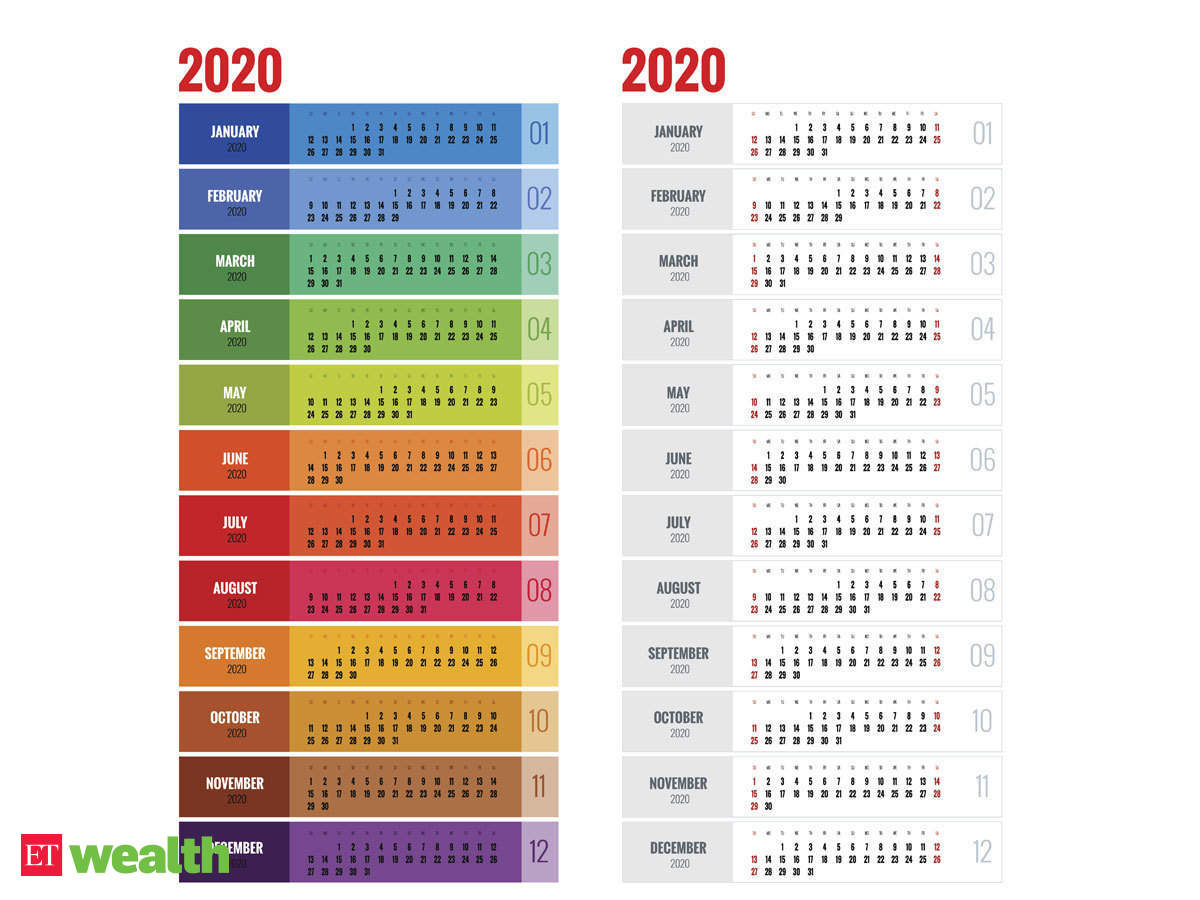

Income Tax Calendar For The Year 2020 Income Tax Calendar Important Tax Dates In 2020

Income Tax Calendar For The Year 2020 Income Tax Calendar Important Tax Dates In 2020

/how-soon-can-we-begin-filing-tax-returns-3192837_final-eab4eb98b0394fb1b93c6dc6876b4062.gif) When Is The Earliest You Can File Your Tax Return

When Is The Earliest You Can File Your Tax Return

Tax Deadline 2020 When Are My State Taxes Due Amid Coronavirus

Tax Deadline 2020 When Are My State Taxes Due Amid Coronavirus

Your Bullsh T Free Guide To Taxes In Germany

Your Bullsh T Free Guide To Taxes In Germany

Tax Day 2021 Deadline The Last Day You Can File And How To Get An Extension Cnet

Tax Day 2021 Deadline The Last Day You Can File And How To Get An Extension Cnet

Comments

Post a Comment