Featured

- Get link

- X

- Other Apps

How To Get Out Of Irs Debt

Ask to Delay Your Collection This is one of the best routes to take if you find that you owe the IRS money in the form of back taxes. Generally the Chapter 7 bankruptcy gives you better odds at beating all of your IRS debt since it allows for a complete and total discharge of all debts owes but the Chapter 13 bankruptcy is a little easier to qualify for even though it only allows you to discharge some of your debt and forces you to set up a payment plan for the remaining amount that the IRS refuses to give up on.

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/HowtoGetOutofTaxDebt-8b3e341100c54eca97daf155d227d28d.jpg) How To Pay Off Tax Debts With The Irs

How To Pay Off Tax Debts With The Irs

Dealing with tax debt.

How to get out of irs debt. If you dont pay your tax bill by the due date the IRS compound the interest on your back tax debt until the day you pay it up. There are a few. Pay what you can as soon as possible A smart way out of huge tax debt is to pay it up immediately.

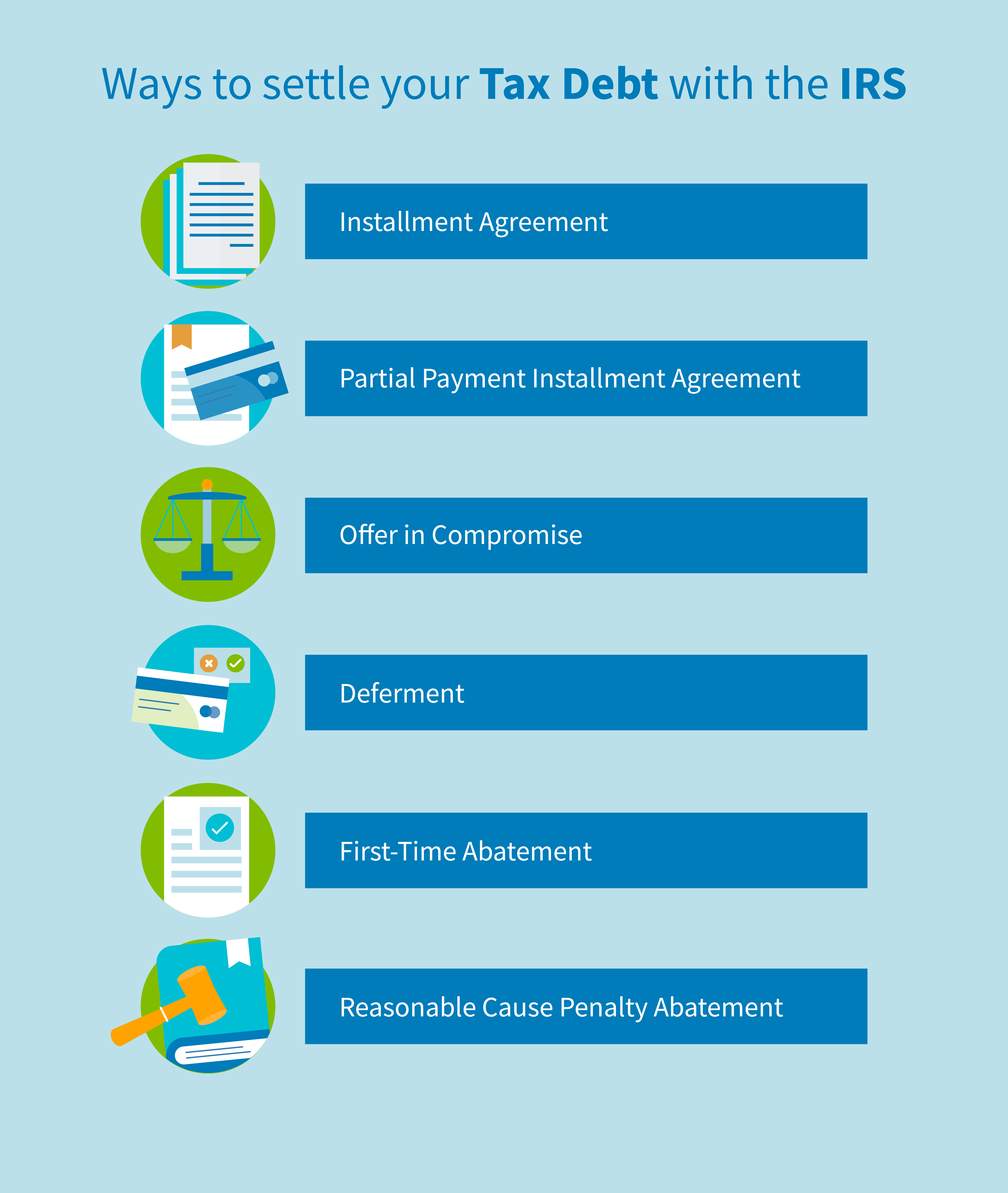

How to pay off tax debt that the IRS wont forgive Pay with an installment agreement payment plan. These resources can help you understand the collection process and the consequences you may face because of tax debt. I have to tell you though as I sat down to write this strategy note it made me think about some clients that Ive worked with over the years who fought their way successfully out of debt that would have crushed other Charlotte families.

Earn more and use every extra dollar to whittle away your debt burden. This means you settle your debt for less with the stipulation that the IRS gets the agreed upon money all at once. Get realistic about your situation and dont ignore the fact that something needs to be done.

This program allows you to make a lump sum payment on your IRS tax debt that is lower than what you actually owe. One option is to pay your tax debt with a payment plan. However with the help of an experienced tax attorney or specialist you may be able to plan out a way to wait out the IRS.

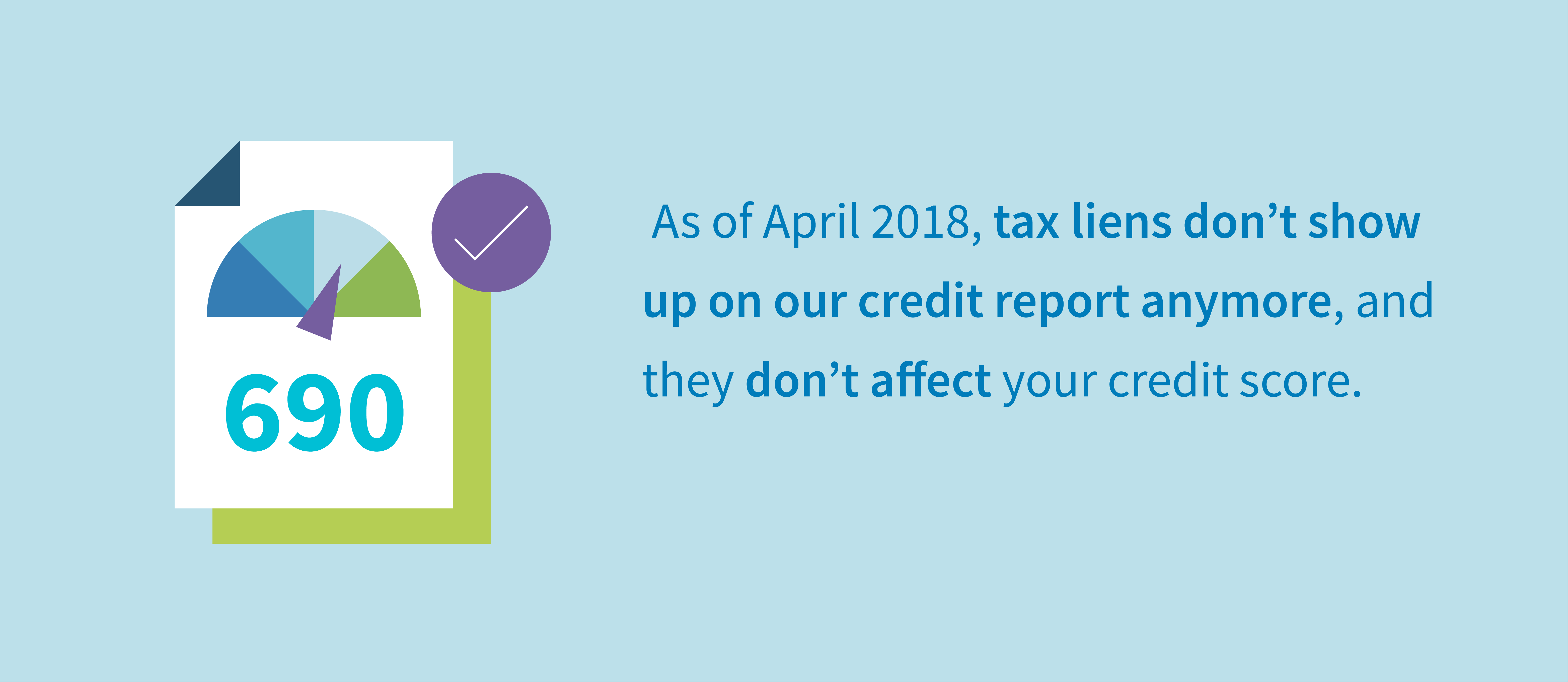

The IRS collection office can move quickly to come after your wages assets and accounts. If you believe there might be an error in the amount of taxes the IRS says you owe the first option is to call the IRS provide proof. 5 tips to set things right with the IRS There are steps you can take to reduce the impact of unpaid taxes on your life credit and financial well-being.

In the meantime the lien will attach to all your existing and future assets until its lifted and will have a negative impact on your credit. Some people can also qualify for an offer in compromise which is. There are quite a few options.

There are compatibility issues with some assistive technologies. Depending on how much you owe. Although the Internal Revenue Service is known for relentlessly pursuing those who havent paid their taxes you may be able to request a delay.

A tax attorney or specialist can likely negotiate the best rate for you. Pay the IRS with alternative funds. Installments come with interest but according to this Defense Tax Group article there is a fairly new debt management program where you have a long term payment plan to pay off the IRS at a reduced dollar amount.

If you carry the average credit card balance of 15609 pay a typical 15 APR and make the minimum monthly payment of 625 it will take you 135 years to pay it off. There are essentially three ways to achieve this. The Offer in Compromise is another IRS program that can help you reduce your tax debt.

One way to get out of debt with the IRS is to make your payments to them in installments. In the united states the interest is 3 percent plus the federal short-term rate. The best way to get rid of a lien is to pay your taxes in full after which the IRS will lift the lien within 30 days.

Earn more and spend less and go after your debt with an evangelists vengeance. Understanding the IRS Collections Process. You may find that using an alternative source of.

IOS 11 macOS 1012 and macOS 1013 VoiceOver users may experience difficulties when accessing this. If you ever wondered how to get out of IRS debt this is a viable option. Spend less and again use freed-up dollars to attack debt.

Acting quickly will help minimize any financial damage you may face. Waiting out the IRS isnt going to be your best option in most cases. You should be able to access an installment plan with the IRS.

Taxpayers who owe from 50000 up to 100000 can get into a streamlined installment agreement to pay the debt over 84 months or seven years. This is typically only applicable if financial hardship is a factor. Among the highlights of the Taxpayer Relief Initiative.

The IRS is offering flexibility for some taxpayers who are temporarily unable to meet the payment terms of an accepted Offer in Compromise. Pay more than the minimum payment. When you owe money to the Internal Revenue Service there are a few ways that you could potentially get out of the debt.

Taxpayers who qualify for a short-term payment plan option may now have up to 180 days to resolve their tax liabilities instead of 120 days. Often when youre faced with IRS debt there are other nasty little financial problems out there that can tend to crop up. Refer to the accessibility guide for help if you use a screen reader screen magnifier or voice command software.

If youre ready to get out of debt consider these tried-and-true methods. 2 Streamlined simply means that the IRS wont investigate your current financial situation and youll have fewer forms to fill out.

Best Ways To Pay Off Your Irs Debt Infographic With Tips Debt Reviews

Best Ways To Pay Off Your Irs Debt Infographic With Tips Debt Reviews

2020 Guide To The Irs Tax Debt Forgiveness Program Forget Tax Debt

2020 Guide To The Irs Tax Debt Forgiveness Program Forget Tax Debt

What Is The Irs Debt Forgiveness Program Tax Defense Network

What Is The Irs Debt Forgiveness Program Tax Defense Network

How To Get Out Of Tax Debt Credit Repair Com

How To Get Out Of Tax Debt Credit Repair Com

What Is The Irs Debt Forgiveness Program Tax Defense Network

What Is The Irs Debt Forgiveness Program Tax Defense Network

Tax Debt Forgiveness How To Get Your Tax Debt Forgiven Debt Com

Tax Debt Forgiveness How To Get Your Tax Debt Forgiven Debt Com

How Much Do I Owe The Irs 4 Ways To Find Out Tax Defense Network

How Much Do I Owe The Irs 4 Ways To Find Out Tax Defense Network

How To Get Out Of Tax Debt Credit Repair Com

How To Get Out Of Tax Debt Credit Repair Com

Tax Debt Forgiveness How To Get Your Tax Debt Forgiven Debt Com

Tax Debt Forgiveness How To Get Your Tax Debt Forgiven Debt Com

Help With Irs Debt 11 Ways To Negotiate Settle Tax Debt

Help With Irs Debt 11 Ways To Negotiate Settle Tax Debt

How To Get Out Of Irs Debt Youtube

How To Get Out Of Irs Debt Youtube

Tax Debt Relief The Ultimate Guide For Survival During Tax Time

Tax Debt Relief The Ultimate Guide For Survival During Tax Time

Get Out Of Irs Tax Debt And End Problems With Back Taxes Debt Com

Get Out Of Irs Tax Debt And End Problems With Back Taxes Debt Com

:max_bytes(150000):strip_icc()/federal-tax-liens-3193403_final-ae94abda07d54e318b9b6388610fee1f.gif) How To Pay Off Tax Debts With The Irs

How To Pay Off Tax Debts With The Irs

Comments

Post a Comment