Featured

Retiring At 62 Pros And Cons

But as you probably already know just because you may do something doesnt necessarily mean you should do it. Your 62nd birthday has just arrived and with it came an overwhelming temptation to retire.

Retiring At 62 Vs 70 Pros And Cons The Paseo Financial Group

Retiring At 62 Vs 70 Pros And Cons The Paseo Financial Group

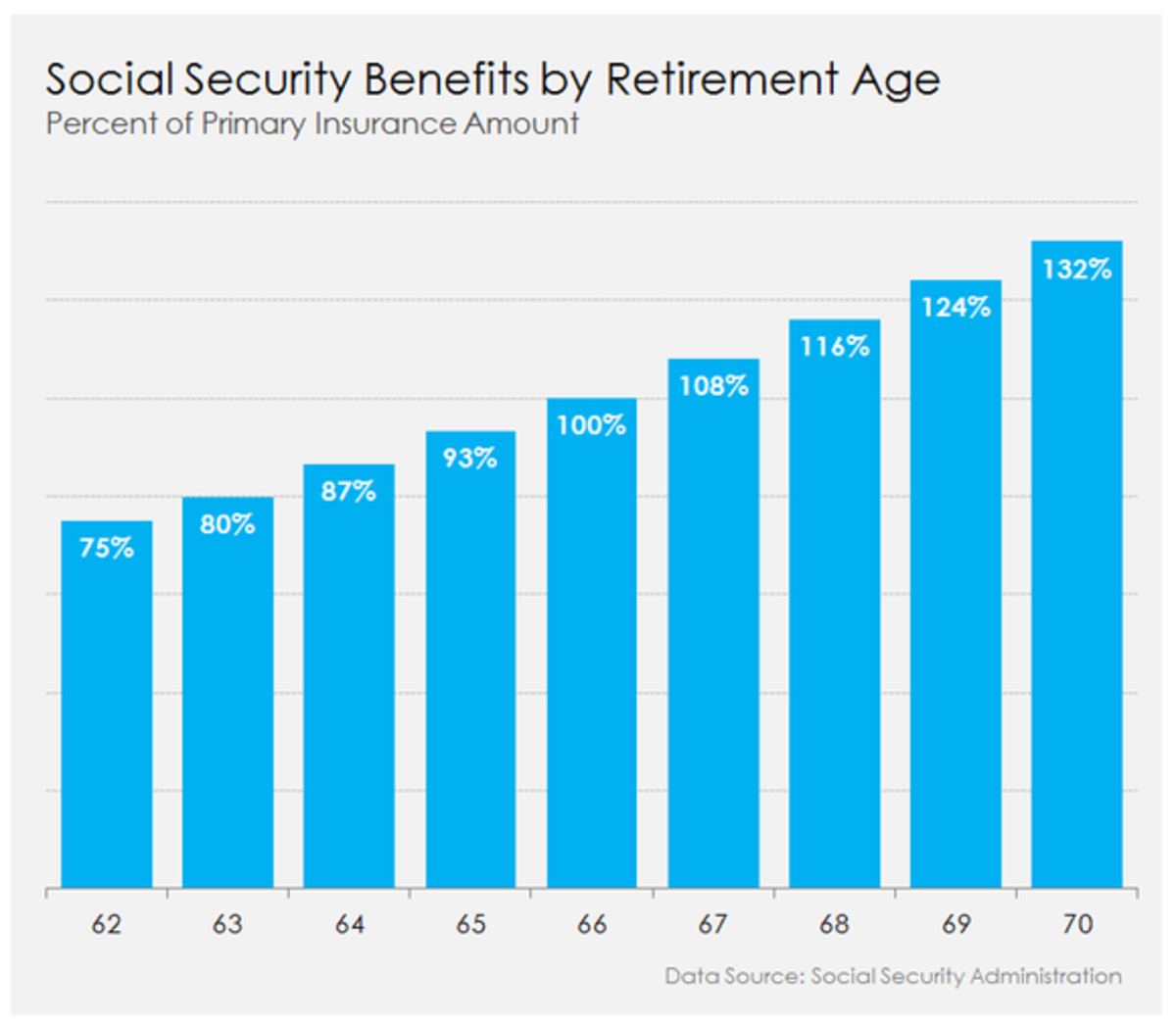

For those who retire at age 62 and begin taking benefits the monthly benefit will be 30 smaller or more when compared to if benefits were taken at age 67.

Retiring at 62 pros and cons. Retiring at 62 from a backbreaking job or one with a disproportionately high level of stress can help you retain or regain your good health and keep it longer. Cons of claiming Social Security at 62 While claiming Social Security at 62 may sound good the biggest disadvantage is youll get a significantly reduced. For those who can wait until age 70 to start taking the benefit the amount may increase by up to 8.

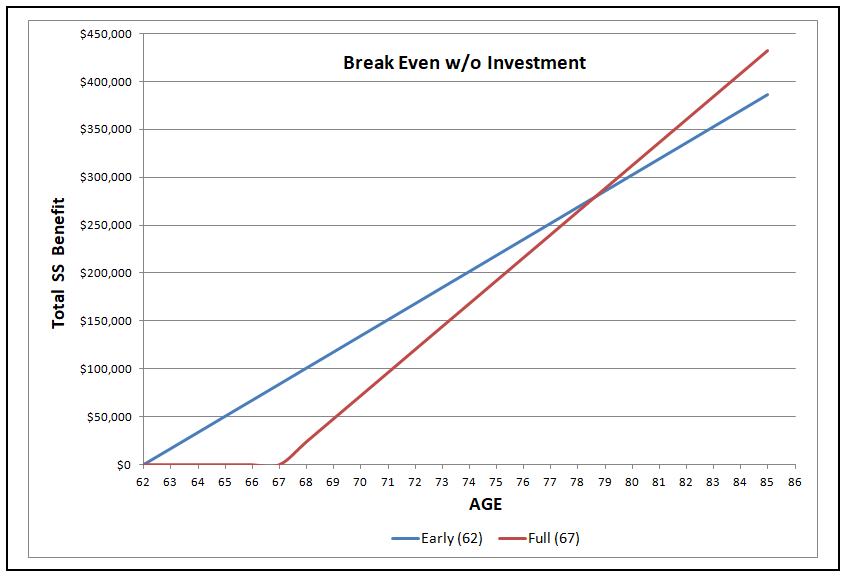

Jobs are good for keeping you engaged but not the only. Youll get more income each month for the rest of your expected lifetime by waiting until your full retirement age or even longer before beginning your benefits. If you retire at age 62 and live to 90 lets say your individual retirement accounts IRAs and other savings will have to cover you for 28.

Early retirement plus the extra benefits when you wait to claim. You can start collecting your benefits as early as age 62 and as late as age 70. Retiring in your early fifties may allow you to spend more time with your family and better parent children throughout their teens and early adulthood.

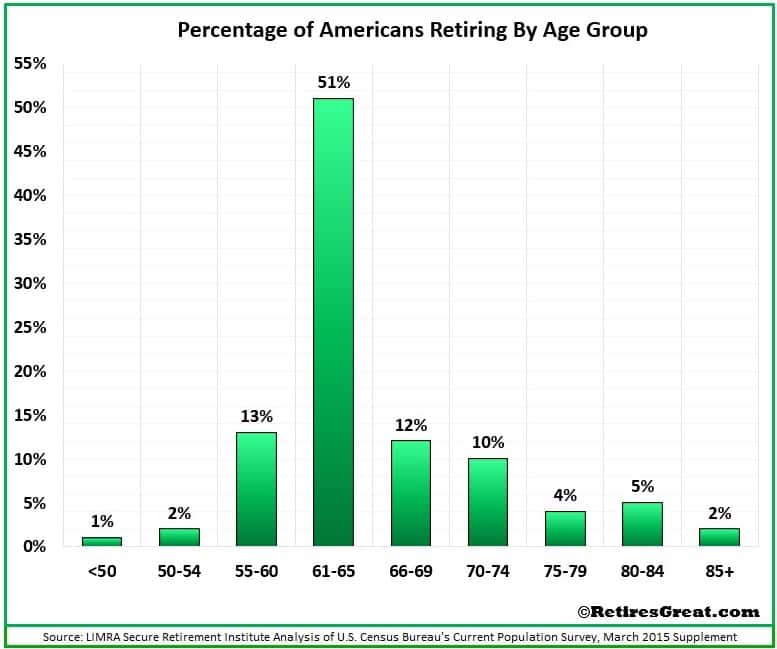

Data from the Center for Retirement Research at Boston College states that age 62 is the most common period to claim Social Security benefits. Whose retirement plan doesnt include at least. Just be sure to have a plan for being mentally socially and physically active.

If that happens youll end up with a lower average since years of 0 wages are factored into it. The Opportunity to TravelActively. If your full benefit amount or the amount youd receive if you wait until your FRA to claim is 1400 per.

For every year beyond your full retirement age that you delay starting to receive retirement benefits. If you retire at 62 theres a chance you may not have a full 35 years on the job. Men retire at an average age of 64 while for women the average retirement age is 62.

Investing extra time in loved ones pays dividends for the entire household. Taking benefits early does come with a monetary monthly penalty of up to 30 for those enrolling in benefits at 62 versus their full retirement age of 67. If your FRA is 66 for example your benefits will be cut by 25 if you claim at age 62.

1 So whether its traveling taking up new hobbies or simply finding a part-time job with less stress its. If your retirement fund is solid and you have enough to live comfortably without Social Security you can have the best of both worlds. Cons It is possible to claim benefits early while youre still working which can give you some extra spending money while you continue to build your nest egg but there are restrictions if you havent reached.

So is retiring at 62 a good idea. Your retirement savings will have to last longer. When you start Social Security before your full retirement age which is currently 66 and rising to 67 for people born in 1960 and later you will lose 1 of benefits for every 2 you earn over a.

After working hard for decades taking Social Security at age 62 may seem like a good idea but for a whole lot of people it is not the best financial decision you can make. 62 is the first year youre eligible for Social Security but your benefit amount will lower. There must be a financial plan in place to manage the extra time.

According to the rules of the Social Security Administration you are allowed to retire and claim benefits at the age of 62. The pros of claiming Social Security at 62 The biggest argument for taking Social Security early is that doing so provides you with the potential to receive benefits over a longer period of time. You can reconnect with a spouse who ran the household while you pulled long hours at the office.

Essay Tips Retiring At 62 Pros And Cons Freeeducator Com

Essay Tips Retiring At 62 Pros And Cons Freeeducator Com

The Pros And Cons Of Claiming Social Security Early During The Covid 19 Pandemic Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

The Pros And Cons Of Claiming Social Security Early During The Covid 19 Pandemic Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Should You Retire At 62 Or Work A Few More Years Retires Great

Should You Retire At 62 Or Work A Few More Years Retires Great

Retiring At 62 Vs 70 Pros And Cons Markets Stocks Billingsgazette Com

Retiring At 62 Vs 70 Pros And Cons Markets Stocks Billingsgazette Com

Things To Know Before You Plan To Retire At 62 Wiseradvisor Com

Things To Know Before You Plan To Retire At 62 Wiseradvisor Com

7 Reasons For Retiring At 62 Pros And Cons Moonriver Pearls

7 Reasons For Retiring At 62 Pros And Cons Moonriver Pearls

/GettyImages-1071396306-fa10a1f982704bd4b4f9b3ad64bcbcbb.jpg) The Pros And Mostly Cons Of Early Retirement

The Pros And Mostly Cons Of Early Retirement

7 Reasons For Retiring At 62 Pros And Cons Moonriver Pearls

7 Reasons For Retiring At 62 Pros And Cons Moonriver Pearls

How Much Money Do I Need To Save To Retire At 62 Goodlife

How Much Money Do I Need To Save To Retire At 62 Goodlife

How Much Money To Retire At 62 Page 6 Line 17qq Com

How Much Money To Retire At 62 Page 6 Line 17qq Com

:max_bytes(150000):strip_icc()/grandfather-and-granddaughter-volunteers-painting-vibrant-mural-on-sunny-urban-wall-1096101642-842bb4899aa14c00bea80f53ee7f11a7.jpg) When To Retire The Pros And Cons Of Different Ages

When To Retire The Pros And Cons Of Different Ages

Social Security At 62 Or 67 Understanding All Potential Impacts Seeking Alpha

Social Security At 62 Or 67 Understanding All Potential Impacts Seeking Alpha

18 Pros And Cons Of Retiring At 62 Vittana Org

18 Pros And Cons Of Retiring At 62 Vittana Org

Here Are The Pros And Cons Of Claiming Social Security At 62 The Motley Fool

Here Are The Pros And Cons Of Claiming Social Security At 62 The Motley Fool

Comments

Post a Comment