Featured

How Does A Tax Extension Work

The income tax extension only extends the amount of time you have to finalize your return typically to October 15. Some states accept IRS extensions while others require you to file a separate state extension form.

How To File An Extension For Taxes Form 4868 H R Block

How To File An Extension For Taxes Form 4868 H R Block

Missing the deadline will result in a penalty plus interest on the amount you owe.

How does a tax extension work. How does a tax extension work. The extension will grant you a six-month extension allowing you to turn in your taxes six months later on October 15th. What exactly is a tax extension.

But if you need more time you will need to file for an extension with Form 4868. If you owe taxes filing an extension can help you avoid the tax filing penaltywhich can be severe. However the IRS does grant you an automatic extension to file your taxes every year as long as you complete Form 4868.

The Internal Revenue Service allows taxpayers to file for an extension if they need more time to prepare their tax return. The correct presentation of an extension means that no penalty for delay will be imposed unless the return is submitted within an extended period. Running out of time to do your taxes.

A tax extension only gives you more time to file and you still always need to pay your tax bill if you we one by Tax Day. The IRS allows individuals businesses and properties to file an income tax return after the deadline by obtaining an extension. Your federal taxes are still due on May 17 so if you dont pay them by then you will incur penalties and interest.

But what it doesnt do is give you an extension on your payment. The Pros of A Tax Extension. Filing for a six-month extension is simple.

An extension moves the filing deadline from Tax Day to October 15 but it doesnt give you extra time to pay taxes you might owe on that return. In a normal tax year without IRS exceptions this would mean pushing your filing deadline from April 15 to Oct. Theres no charge or fee for submitting a tax extension form.

You simply need to have it in before the tax due date typically April 15. A tax extension will not usually give you more time to contribute to a 401 k or IRA. A tax extension gives you more time to file your return but it doesnt give you more time to pay if you owe taxes.

You dont need to. Filing a tax extension request using IRS Form 4868 asks the Internal Revenue Service IRS to give you additional time to file your personal tax return. Simply submit IRS Form 4868 and youll be.

Note that for this extension Puerto Rico does not count as abroad The IRS also extends an automatic 180-day. The penalty is charged for each month or part of a month the tax is unpaid. Taxpayers who live and work abroad have an automatic two-month extension to file their tax returns putting their filing deadline at June 15.

The IRS automatically processes a tax-return filing extension if you pay all or part of your taxes electronically by the deadline. A filing extension is an exemption that can be made to either individual taxpayers or businesses that are unable to file a tax return to the federal government by the due date. You can obtain a tax extension for any reason.

While youll avoid penalties for not filing youll still be liable for any amount you actually owe. There are a number of benefits to submitting a tax extension. Simply put a tax extension gives you six extra months to do your taxes.

Common reasons for requesting an extension include a lack of organization unanticipated events or tax planning purposes. You still owe IRS payment on July 15 2020. They do not have to file Form 4868 but when they file their returns in June they must include proof that they do indeed live and work abroad.

Some of them you may not have even considered. The late payment penalty is usually ½ of 1 of any tax not paid by the regular due date of your return. How tax extensions work The beauty of tax extensions is that you dont need a specific reason to request one.

What Are Tax Extensions and how does it Work. Tax extension forms for 2020 are due by May 17 2021. The extension of the federal income tax filing and payment deadline to May 17 is completely automatic.

This extension is for six months and applies only to filing. Even if you obtain an extension to file you must still pay your income tax in full by. What doesnt get extended.

Filing for an extension will give most taxpayers until October 15 to file their returns. If you owe money to the IRS those taxes are still due on May 17 if you want to avoid penalty fees and interest. A tax extension gives you an additional 6 months to file your tax return making your new deadline October 15.

The IRS grants them automatically as long as you complete the proper form on time. Weve got more on that. Traditionally federal tax returns are due on April 15 or the first business day thereafter.

Check your state tax laws. It is not an extension of time to pay your tax bill. Watch this video to understand exactly what a tax extension is and what it is.

You must pay any outstanding tax bill by April 15 or the government will charge.

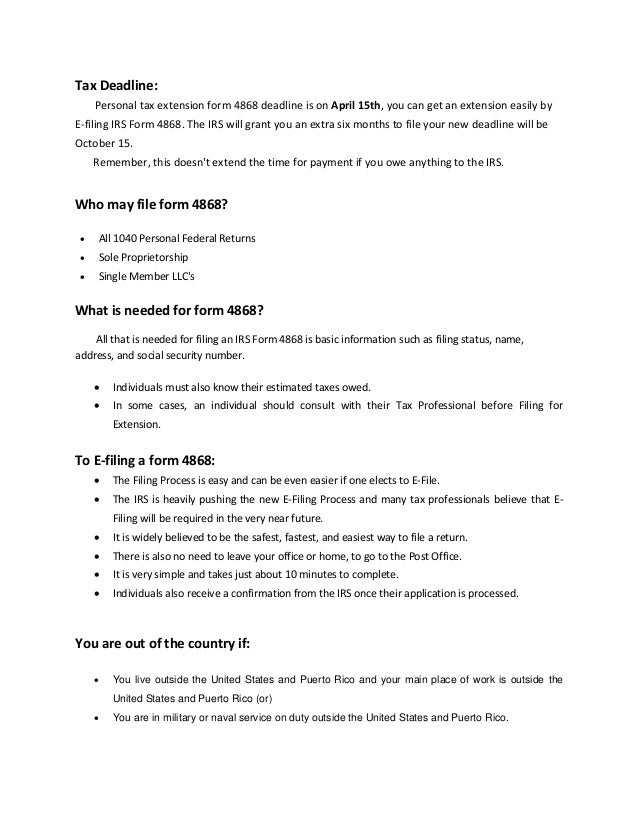

Personal Tax Extension Form 4868

Personal Tax Extension Form 4868

Tax Day 2021 Deadline The Last Day You Can File And How To Get An Extension Cnet

Tax Day 2021 Deadline The Last Day You Can File And How To Get An Extension Cnet

:max_bytes(150000):strip_icc()/486990777-56a938bc3df78cf772a4e5f7.jpg) The Pros And Cons Of Filing A Tax Extension

The Pros And Cons Of Filing A Tax Extension

How To Get An Additional Tax Extension H R Block

How To Get An Additional Tax Extension H R Block

Tax Extension Form 4868 E File By May 17 2021

Tax Extension Form 4868 E File By May 17 2021

Tax Extensions What You Need To Know Ramseysolutions Com

Tax Extensions What You Need To Know Ramseysolutions Com

What S The Deadline For Filing My Tax Return Taxfix

What S The Deadline For Filing My Tax Return Taxfix

Filing An Income Tax Extension How When In 2021 Nerdwallet

Filing An Income Tax Extension How When In 2021 Nerdwallet

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/TheProsandConsofFilingaTaxExtension-ad990678a5e346c880be2331cac03f40.jpg) The Pros And Cons Of Filing A Tax Extension

The Pros And Cons Of Filing A Tax Extension

How Do I File For A Tax Extension Get It Back Tax Credits For People Who Work

How Do I File For A Tax Extension Get It Back Tax Credits For People Who Work

Tax Extensions What Are Tax Extensions And How Does It Work Tax Professionals Member Article By Larry Hurt

Tax Extensions What Are Tax Extensions And How Does It Work Tax Professionals Member Article By Larry Hurt

Everything You Need To Know About The 2021 Tax Deadlines Forbes Advisor

Everything You Need To Know About The 2021 Tax Deadlines Forbes Advisor

How To File For An Extension Of State Taxes Turbotax Tax Tips Videos

How To File For An Extension Of State Taxes Turbotax Tax Tips Videos

How Do Tax Return Extensions Work What Happens If I Extend My Tax Return Irs Form 4868 Example Youtube

How Do Tax Return Extensions Work What Happens If I Extend My Tax Return Irs Form 4868 Example Youtube

Comments

Post a Comment